Most sales professionals in Europe have tried Cognism. It’s the brand tied to Diamond Data® mobiles and GDPR compliance.

For years, it looked like the safe choice. But safe doesn’t always mean best when considering contact data accuracy. A $15k starting contract, credits that reset under fair-use terms, and thin coverage outside Europe make it a tough fit once you need global reach.

That’s why teams are asking a different question now: what else is out there?

Because the real priority isn’t sticking with a familiar logo, it’s finding reliable contact details, coverage that extends to US and APAC, and pricing that actually scales with your pipeline.

This guide pulls together the strongest Cognism alternatives in 2025. You’ll see which tools deliver higher match rates, credit rollover, and cleaner verified contacts - and how they stack up on price, usability, and coverage.

By the end, you’ll know exactly which platform fits your targets and budget, without the waste.

Top Cognism Alternatives: Quick Overview

Tool | Best For | Starting Price | Match Rate/Accuracy | Key Advantage |

|---|---|---|---|---|

FullEnrich | Waterfall enrichment across 20+ providers | $29/month | 85%+ (triple-verified) | Flexible pricing with credit rollover |

Apollo.io | All-in-one sales engagement + data | $59/user/month | 70–85% | Built-in sequencing and dialer |

Seamless.AI | High-volume list building via Chrome extension | ~$79/user/month | 60–75% | Unlimited users on enterprise plans |

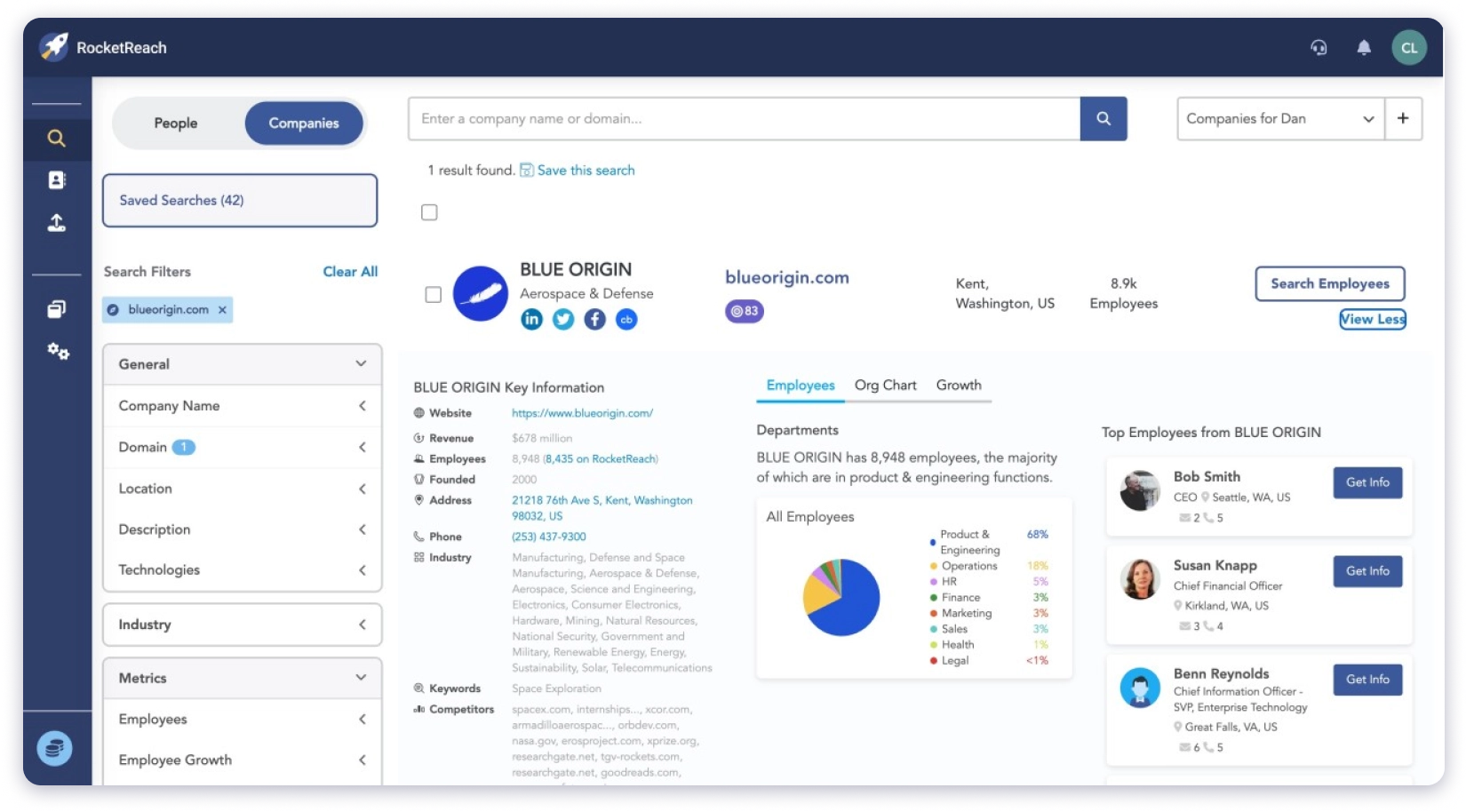

RocketReach | Tech recruiting and global coverage | $69/month | 70–80% | 700M+ profiles with API access |

LinkedIn Sales Navigator | Relationship-based enterprise selling | $99/month | N/A (no direct contacts) | Warm introductions via LinkedIn graph |

Lead411 | US-based high-volume prospecting | $99/user/month | 96% (emails) | Unlimited credits, triple verification |

Kaspr | EU-focused LinkedIn extension | $65/user/month | 85–90% (EU mobiles) | Fast GDPR-compliant LinkedIn prospecting |

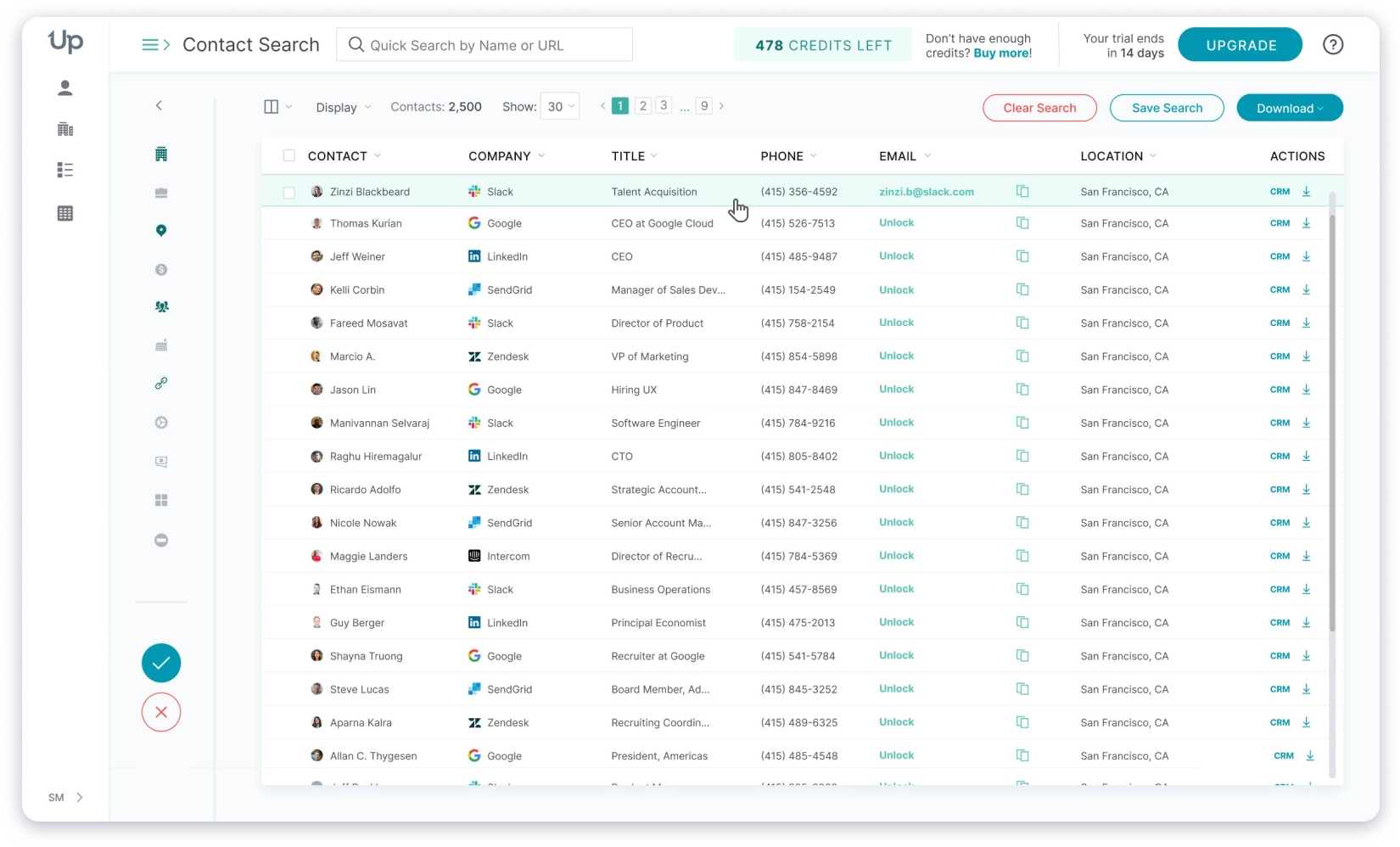

UpLead | Accuracy-first prospecting | $99/month | 95% (guaranteed) | Refunds credits for bounced emails |

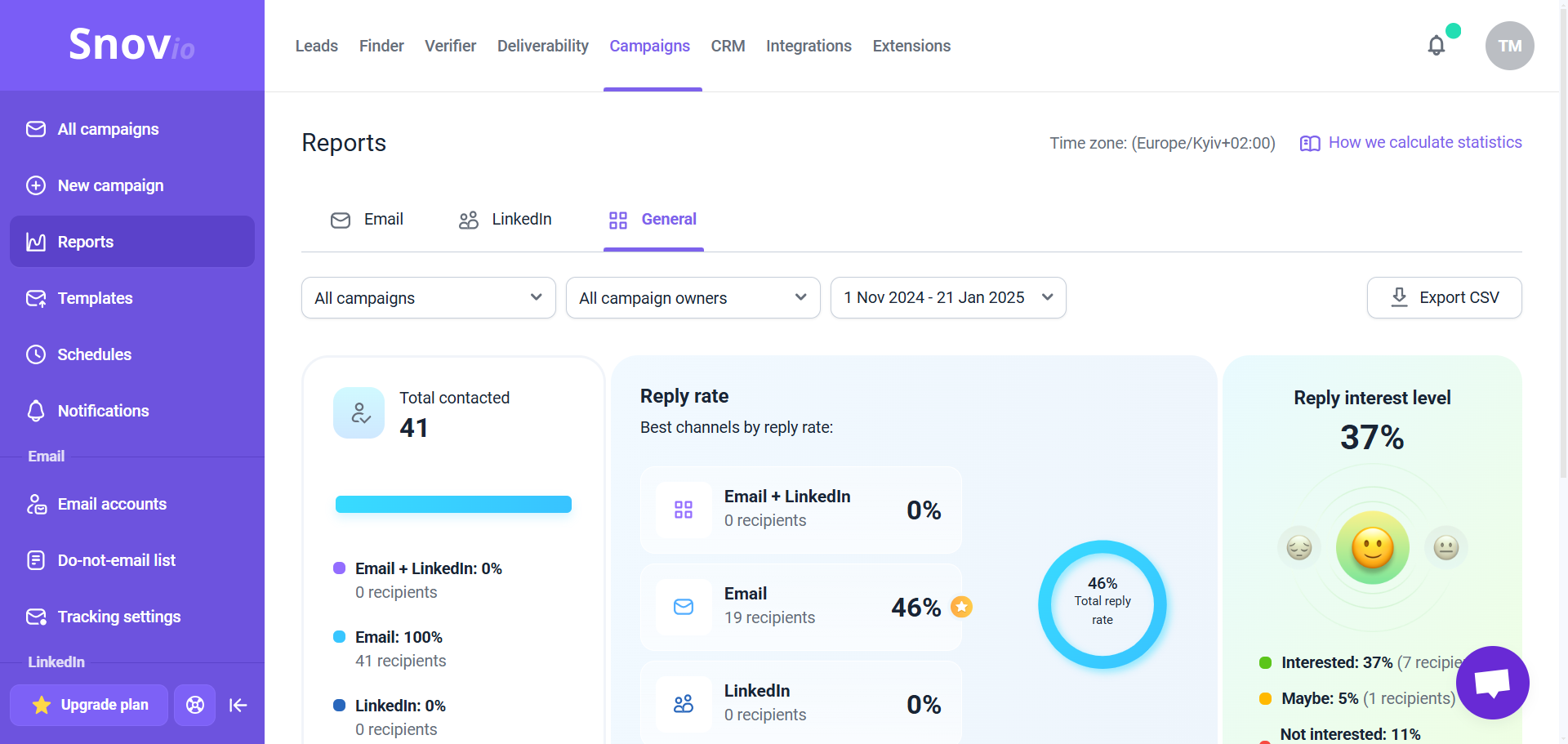

Snov.io | Budget-friendly outreach automation | $39/month | 85% (emails) | Built-in drip campaigns |

Clearbit (Breeze) | HubSpot inbound enrichment | $12K–30K/year | ~85% | Real-time enrichment for inbound leads |

Dealfront | European website intelligence + contacts | €99+/month | 80–85% (EU) | Visitor tracking with GDPR data |

Lusha | Simple LinkedIn-based contact discovery | $29/month | 60–70% | Quick setup with Chrome extension |

Use this as a shortlist, then drill into key features, integration capabilities, and whether the vendor offers flexible pricing plans across paid plans.

Our Criteria for Selecting Cognism Alternatives

When choosing the best sales intelligence tool, we evaluated each platform against Cognism on key factors that directly impact day-to-day sales and marketing efforts.

Coverage & Match Rates: Verified contact and company data is the foundation of outbound. We compared average match rates, global reach.

Pricing Transparency: Cognism’s contracts often start at $15k per year. We looked for tools with clear entry pricing, flexible monthly options, and credits that don’t expire unnecessarily. We also considered per user licensing creep and whether paid plans include rollover.

Data Quality: Outdated data and bounce rates drain pipeline efficiency. We focused on platforms with verified emails, phone-verified contacts, and low bounce percentages.

Ease of Use: A tool should speed up prospecting, not slow it down. Setup time, user-friendly interfaces, and quick CRM integrations were all part of the evaluation.

Integration Capabilities: From Salesforce and HubSpot to CSV/API enrichment, the best Cognism alternatives fit seamlessly into existing sales processes and marketing workflows.

Compliance: Preference goes to providers that are GDPR and CCPA compliant and supply CCPA compliant data internationally.

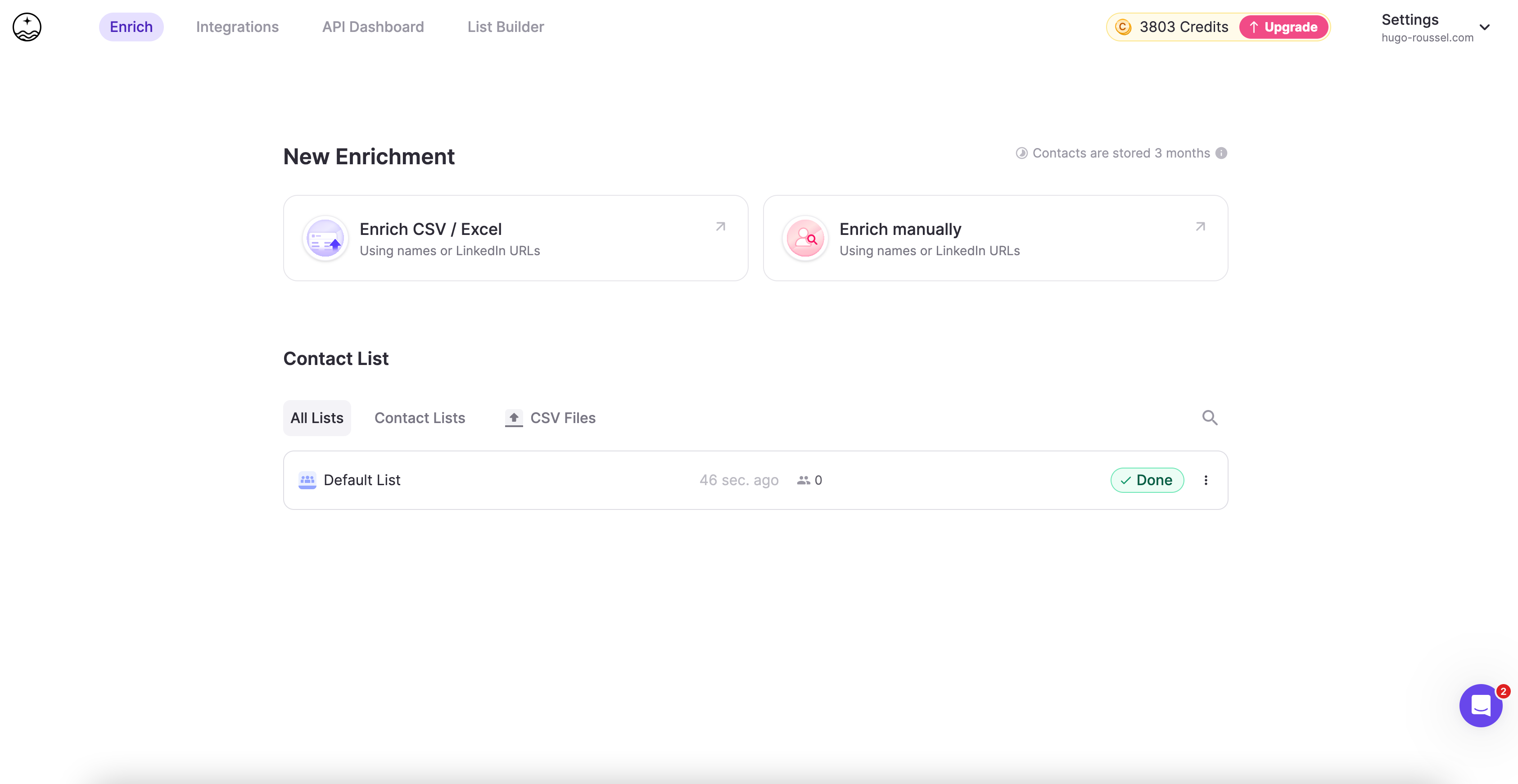

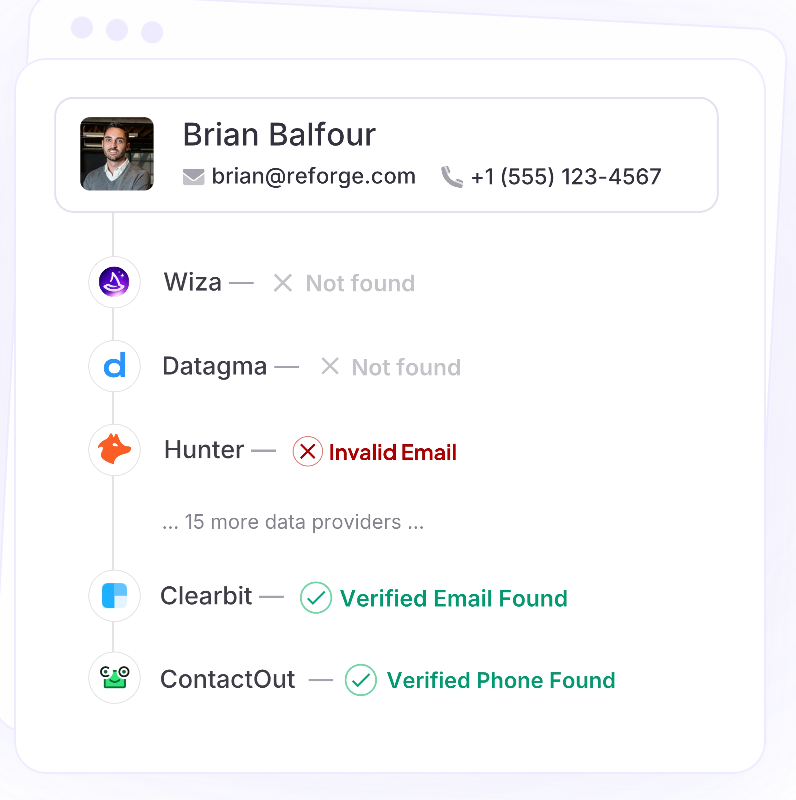

1. FullEnrich

Cognism leans on its own EU database, which limits coverage outside its stronghold. FullEnrich takes a broader route with a waterfall enrichment model that queries 20+ premium providers until it finds a verified match.

That approach consistently delivers 85%+ match rates, while single-source vendors often stall around 60–70%. For sales teams expanding beyond Europe, the result is fewer bounced emails, more verified phone numbers, and stronger pipeline conversion.

Who FullEnrich is for

FullEnrich fits SDR and RevOps teams that need phone-verified contact data at scale without wasting credits or relying on manual vendors.

Key features

Waterfall enrichment across 20+ vetted providers

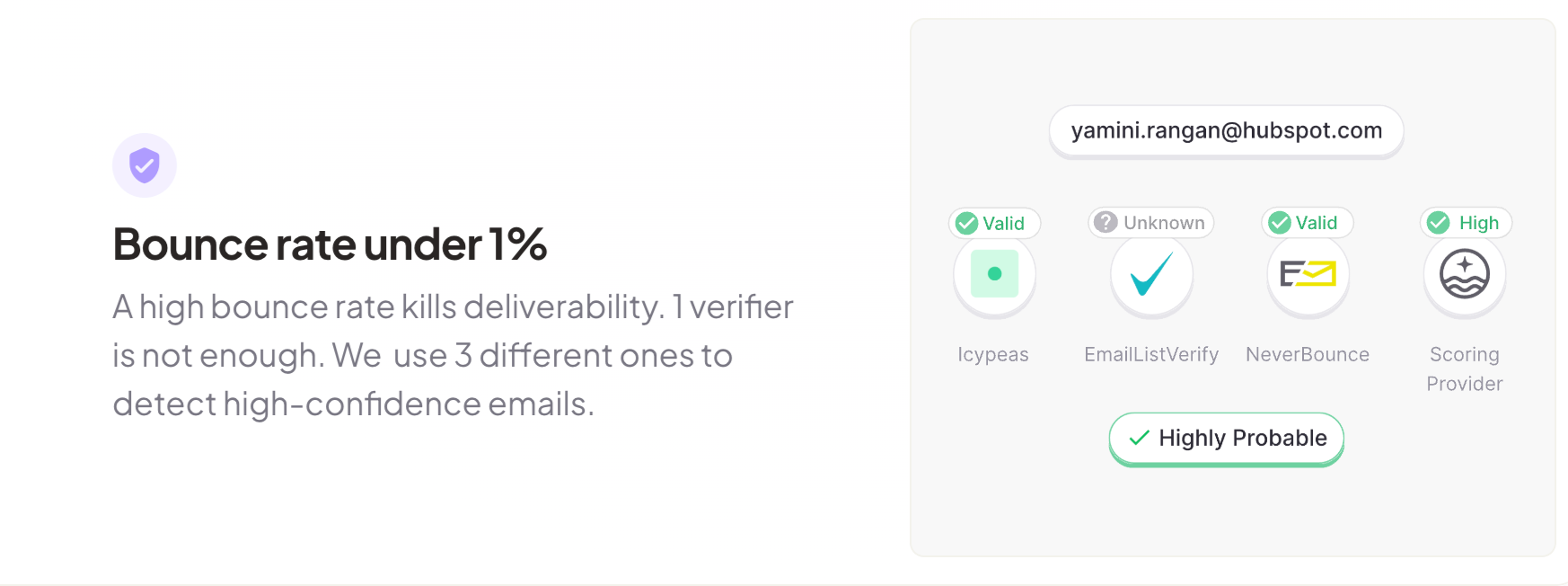

Triple verification on every email, including catch-all detection

Direct work + personal emails, mobiles prioritized over switchboards

Bulk CSV uploads and real time data enrichment via API for fresh account data in your CRM

3-month credit rollover on monthly plans

Unlimited seats on Pro and Scale tiers

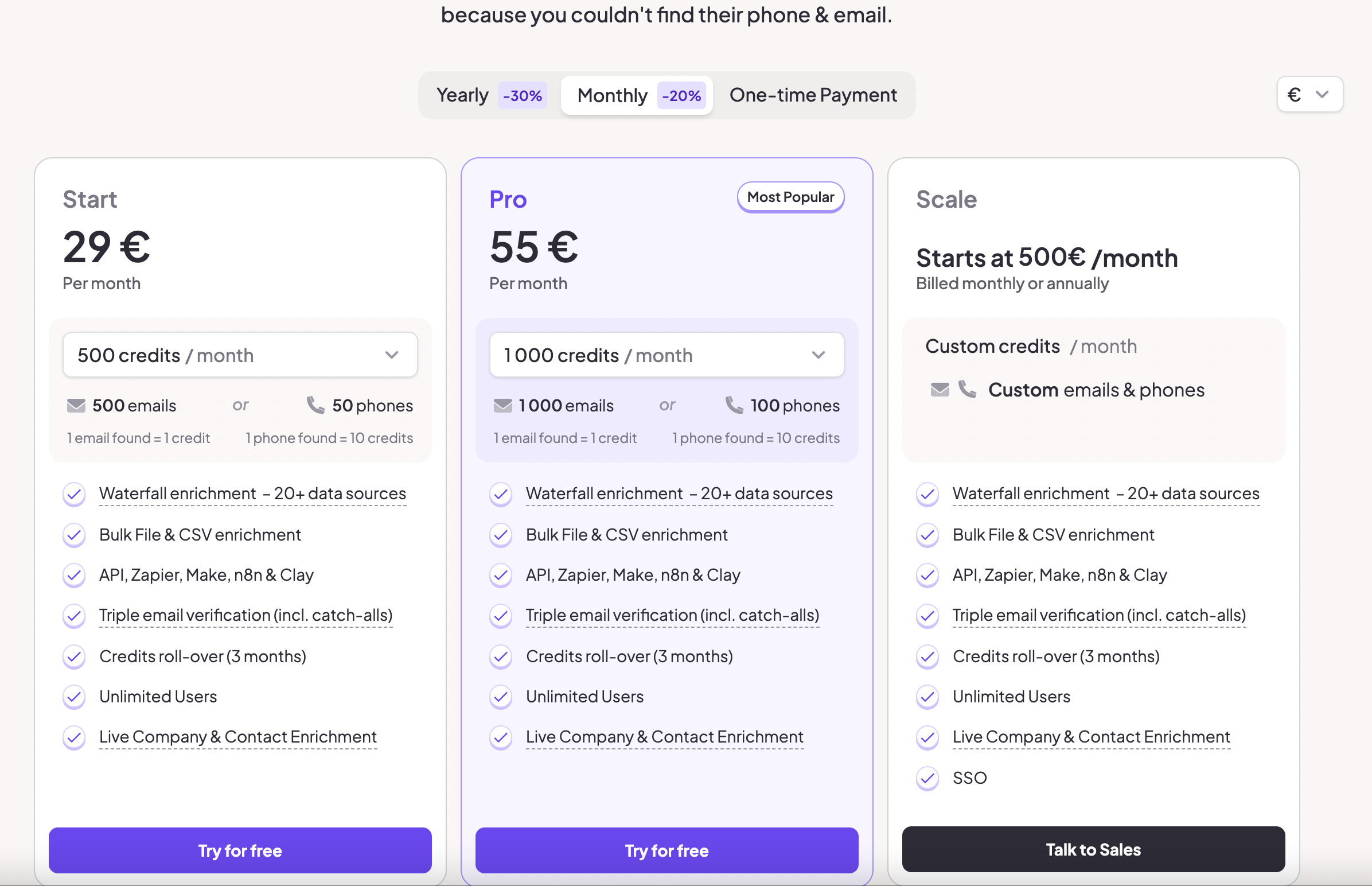

FullEnrich pricing

Free trial: 50 credits

Starter – $29/mo (500 credits)

Pro – $55/mo (1,000 credits)

Scale – custom from $500/mo (volume + SSO)

One-time – $299 (5,000 credits, valid 6 months)

Credits rollover for 3 months so it reduces waste across paid plans as teams scale

Pros & cons

Pros | Cons |

|---|---|

85%+ verified match rates | No built-in sequencer or dialer |

Credits roll over for 3 months | Focused purely on enrichment (not full engagement) |

Transparent, affordable pricing | Limited extras like intent data |

Unlimited team seats at no extra cost | Smaller integration catalog than all-in-one suites |

What makes FullEnrich better than Cognism

Coverage: Cognism is strongest in the EU. FullEnrich spans US, APAC, and niche markets with its 20+ provider waterfall.

Pricing: Cognism contracts typically start at $15k/year. FullEnrich starts at $29/mo, with no lock-in.

Credits: Cognism wipes unused credits each cycle. FullEnrich lets them roll for 3 months.

Accuracy: Cognism runs off one database. FullEnrich triple-verifies emails and prioritizes mobiles, keeping bounce rates under 1%.

Compliance: fully GDPR and CCPA compliant, suitable for global motions.

👉 Try FullEnrich with 50 free credits and see the difference.

What real users say about FullEnrich

On G2, FullEnrich holds a strong 4.8/5 rating, and the same themes keep coming up: accuracy, coverage, and how easy it is to use.

Vianney V., Head of Growth at a small business, put it this way:

“What I like best about FullEnrich is its ability to provide exceptional data quality with a bounce rate of around 1%, the lowest in the industry. This is made possible through its three different email verification services, ensuring high accuracy in the collected information...” (Read full review here)

Another reviewer in the software space kept it simple:

“I appreciate how easy FullEnrich is to use, even for new team members... The tool offers a high success rate in finding emails and phone numbers, making it reliable for contact discovery... I had to reach out to support only once, and their response time was impressively fast." (Read full review here)

The pattern is clear: low bounce rates, reliable contact data, and a user-friendly interface that new reps pick up quickly. For SDR teams, that means less wasted effort and more confidence in the data.

Bottom Line

FullEnrich is the best Cognism alternative for teams that want global coverage, data accuracy, and pricing flexibility (without signing five-figure contracts). With triple verification, credit rollover, and real-time data enrichment, it’s a practical upgrade for scaling sales and marketing efforts worldwide.

Want a leading sales intelligence platform without enterprise lock-ins? Try FullEnrich today for free with 50 credits.

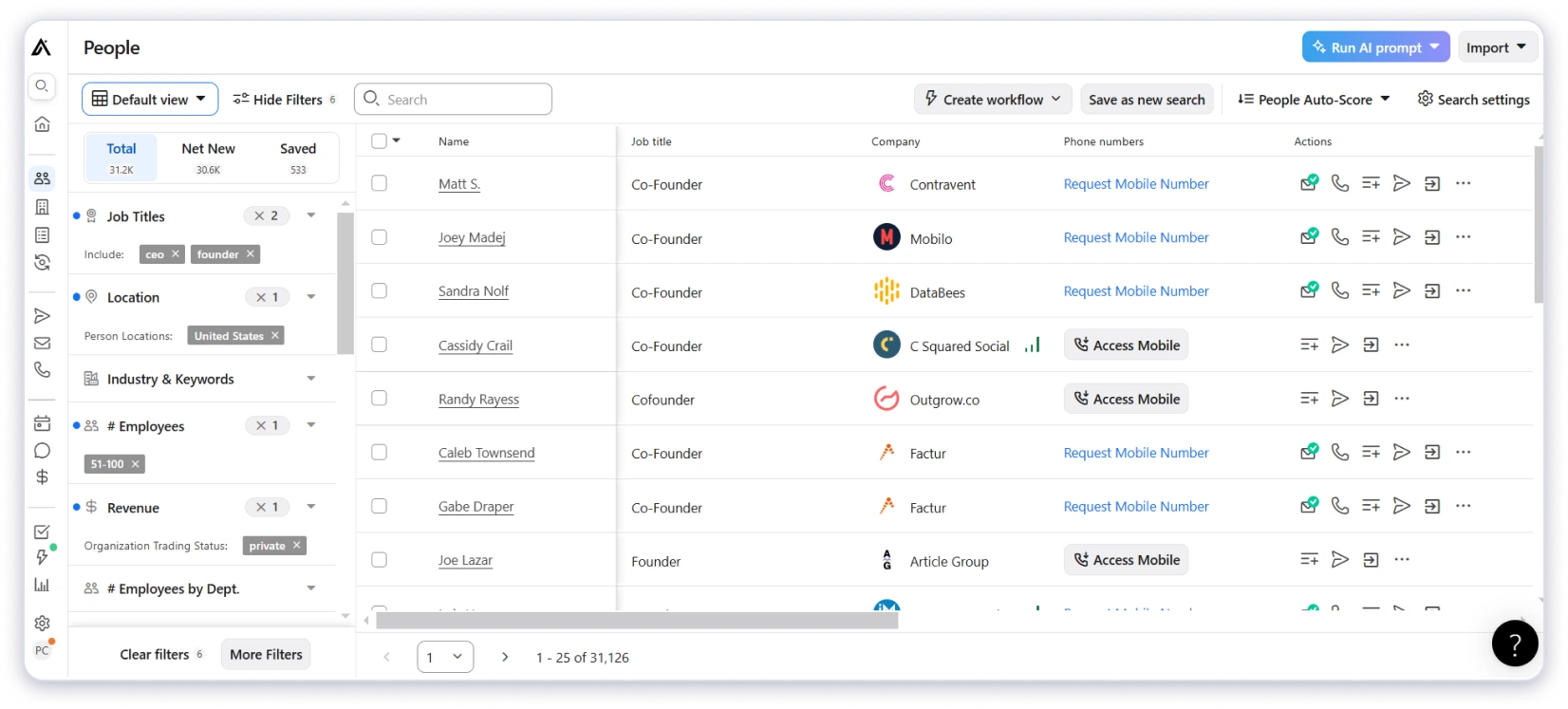

2. Apollo.io

Apollo.io is one of the most widely used sales intelligence tools for SMBs and startups. Unlike Cognism, which focuses on data, Apollo bundles sequencing, a dialer, and CRM sync into one platform.

Besides, it works as a sales engagement platform that reduces manual data entry.

For small teams, this means you can prospect, email, and call in the same workflow without stacking extra tools.

Apollo claims ~210M contacts and 35M companies, strongest in US tech and SMB segments. It’s quick to set up and priced transparently, but phone accuracy varies by industry and geography, and credits don’t roll over—unused ones simply expire.

Who should use Apollo.io

Founders or small teams getting outbound started quickly.

SDR managers who want an affordable platform that combines data enrichment with sequencing.

Key features

~210M contacts / 35M companies (claimed)

Built-in sequencing and dialer (no need for Outreach/Salesloft)

Chrome extension for LinkedIn lookups

Integrations with Salesforce, HubSpot, Gmail, and Outlook

Advanced features like rules-based routing and templates to help standardize outreach

Apollo.io pricing

Free plan available

Basic $59/user/mo (annual $49)

Professional $99/user/mo (annual $79)

Organization $149/user/mo (annual $119)

No credit rollover – unused credits vanish, especially noticeable at scale per user.

Pros & cons

Pros | Cons |

|---|---|

Combines data, sequencing, and dialer in one platform | Phone accuracy inconsistent across regions/industries |

Transparent entry pricing + free plan | No credit rollover – unused credits expire |

Easy setup for small teams | Per-seat pricing adds up as teams grow |

Large user base and active community | Occasional bugs and support complaints |

What Real Users Say About Apollo.io

Apollo.io holds a 4.7/5 rating on G2, but reviews show mixed experiences.

Some users highlight the all-in-one value. As Saqib I., RCM Executive at a small business, put it:

“Apollo combines prospecting, engagement, and CRM-like features in one platform… The email sequencing and automation tools help streamline outreach and improve response rates.” (Source)

Other users warn about serious issues. Adam W., a Founder at a small business, wrote:

“...run for the hills, seriously the data is bad, the billing is worse, and the customer no service even worse!… they will then keep taking money over and over and refuse to refund even when you cancel.” (Source)

The verdict: Apollo earns praise for its all-in-one value, but billing issues and inconsistent accuracy are recurring concerns.

Bottom Line

Apollo is a cost-effective cognism alternative. It's great for lead generation when you want sequencing and data in one place. Just keep in mind the trade-offs: credits expire, and data accuracy isn’t always consistent.

3. ZoomInfo SalesOS

ZoomInfo SalesOS is positioned as the enterprise-grade sales intelligence platform. Its edge is best-in-class US mobile coverage and buyer intent data, while Cognism leans on Diamond Data® for EU-centric, human-verified mobiles.

It is combined with extras like intent signals and Scoops that large sales orgs rely on for account targeting.

Coverage outside the US is decent, but ZoomInfo is still the most trusted, comprehensive sales intelligence option for North American pipelines. Contracts are custom, expensive, and credit rollover isn’t offered, so teams need to budget for heavy annual spend.

Who Should Use

Enterprise teams with a US-heavy target audience.

Organizations that need intent data, Scoops, and technographics layered onto a large contact database.

Key Features

Dominant US database with strong mobile coverage

Add-on modules: intent signals, Scoops, technographics

Deep Salesforce and HubSpot integrations

Enterprise-level support and training

Strong CRM integration and admin controls for complex orgs

Pricing

Custom pricing (enterprise contracts only)

No public entry-level plan

No credit rollover

Pros & Cons

Pros | Cons |

|---|---|

Best-in-class US mobile coverage | High cost, long-term contracts |

Add-ons like intent, scoops, and technographics | Overkill for SMB or startup budgets |

Strong integrations with Salesforce and HubSpot | Complex licensing structure |

Trusted by enterprise sales teams | No credit rollover |

What Real Users Say About ZoomInfo SalesOS

ZoomInfo SalesOS holds a 4.5/5 rating on G2, but users report both strengths and weaknesses.

Some highlight the value of its massive database and integrations. Laura K. (Mid-Market) wrote:

“The database is huge, and there are a lot of filters that allow you to slice your search into endless configurations… The integration and API with Salesforce works well.” (Source)

Others raise concerns about cost and product complexity. Will O., CEO (Mid-Market), shared:

“I liked the idea of ZoomInfo, but they do not deliver on it… they rotate their sales people frequently so I have never had a consistent person to help me improve my usage… I believe it is the most expensive option out there.” (Source)

The pattern: enterprises value scale and integrations, while smaller teams hit walls with price and contract complexity.

Bottom Line

ZoomInfo is the go-to for US enterprises that need scale, mobiles, and advanced add-ons. If your sales process relies on intent data and technographics, it’s worth considering. But without credit rollover and with contract lock-ins, it’s rarely the best fit for mid-market or SMB teams, but best for enterprises that need a comprehensive sales intelligence stack and scale.

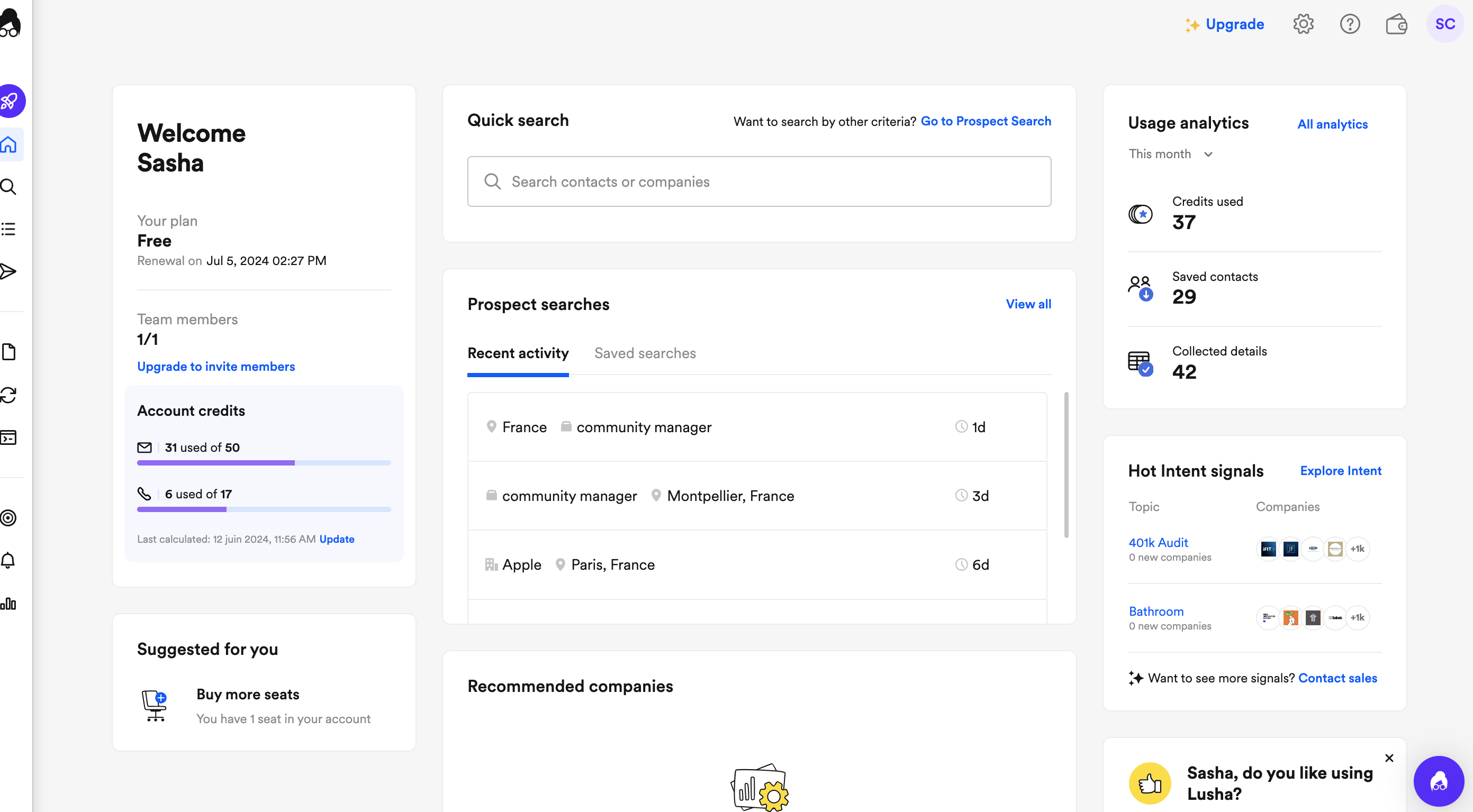

4. Lusha

Lusha is built for SMBs and solo SDRs that need fast, lightweight prospecting without enterprise contracts. Its Chrome extension makes it easy to capture emails and direct dials straight from LinkedIn, making quick lead generation simple for small teams.

The database covers around 280M contacts (claimed), but depth and accuracy lag behind dedicated sales intelligence platforms like Cognism or ZoomInfo.

Where Lusha wins is simplicity: setup takes minutes, and monthly plans include credit rollover up to 2× the monthly cap, which reduces wasted spend compared to “use-it-or-lose-it” competitors.

Who Should Use Lusha

Solo SDRs or small sales teams running quick LinkedIn prospecting.

Recruiters who need a low-friction tool to grab contact details on demand.

Key Features

Chrome extension for instant email/phone lookups

Basic sequencing on paid tiers

CRM integrations (Salesforce, HubSpot, more)

Credit rollover on monthly plans (up to 2× limit)

Pricing

Free plan available

Pro ~$49/user/month

Premium ~$79/user/month

Scale – custom contracts

Monthly rollover included; annual plans reset credits at year end, so choose paid plans carefully.

Pros & Cons

Pros | Cons |

|---|---|

Fast, simple Chrome extension UX | Accuracy varies, weaker than enterprise-grade tools |

Monthly rollover up to 2× reduces waste | Annual plans reset credits (no rollover) |

Affordable entry pricing | Limited enrichment depth vs Cognism/ZoomInfo |

Easy CRM integrations | Credits can exhaust quickly |

What Real Users Say About Lusha

Lusha holds a 4.3/5 rating on G2, with reviews showing both positives and drawbacks.

Some users highlight ease of use and time savings. Murtaza P., Demand Generation Manager (Small Business), wrote:

“Lusha makes it easy for me to find accurate contact details of important decision-makers… The tool is very user-friendly and saves a lot of time for my team.” (Source)

Others raise serious concerns about accuracy and transparency. Trisha G., President and CEO (Small Business), shared:

“... either they are 40% inaccurate or we are one unlucky customer… I wouldn't recommend anyone to this platform… Lusha tricks customers in by their false claims.” (Source)

So, Lusha is quick, affordable, and simple for small teams, but if accuracy and reliability are top priorities, it may not be the best choice.

Bottom Line

Lusha is best when you need contact information fast from LinkedIn. It's also cheap, but its accuracy and coverage can’t match Cognism, ZoomInfo, or FullEnrich.

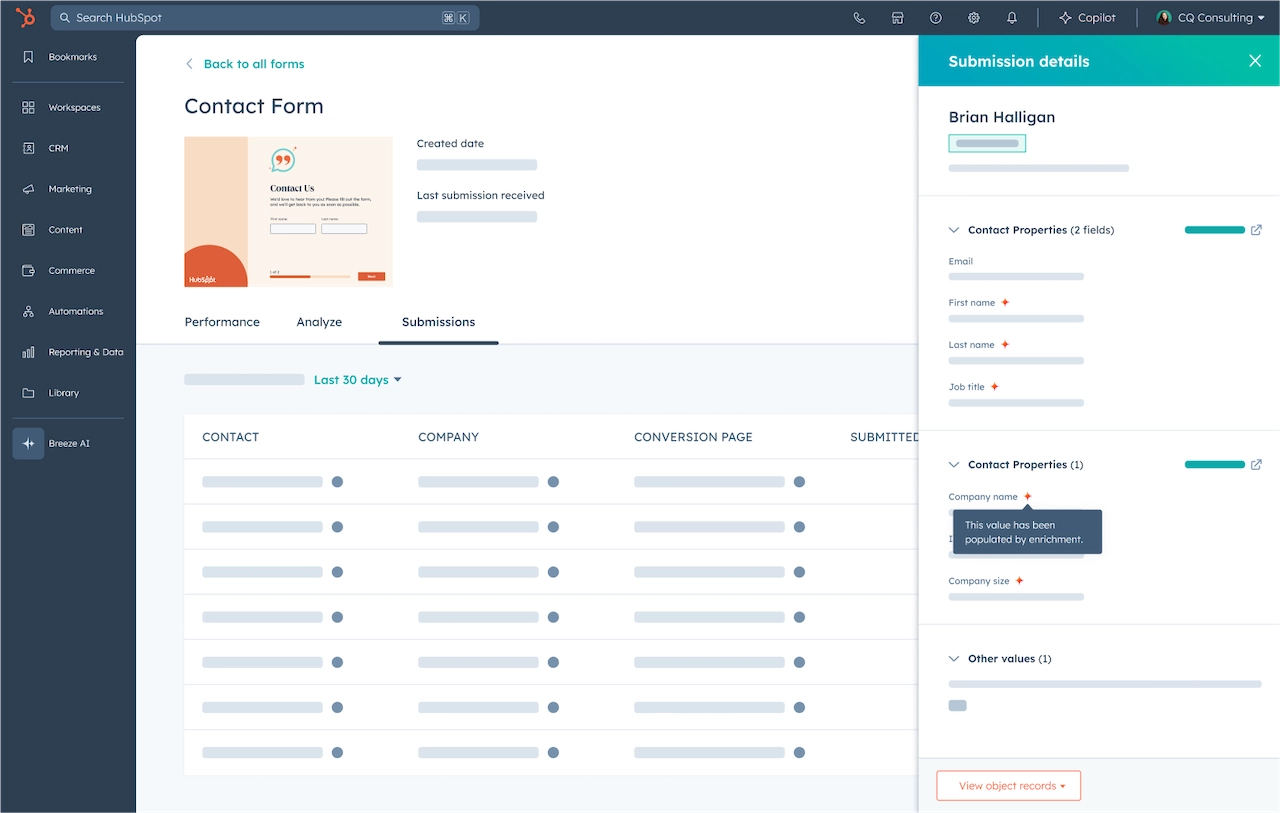

5. Clearbit (by HubSpot, now Breeze Intelligence)

After HubSpot’s acquisition, Clearbit was rebranded as Breeze Intelligence. It remains an inbound enrichment tool, built for HubSpot users who need lead scoring, form enrichment, and visitor identification inside their CRM. Ideal when marketing teams need detailed insights for scoring and routing.

It focuses on company-level firmographics and technographics, not phone-verified contacts. Strong for marketers, weak for outbound sales.

Who Should Use Clearbit

Marketing ops teams improving lead routing and scoring

HubSpot-centric teams that want enrichment built into workflows

Key Features

Real-time form enrichment for lead generation

Website visitor identification from company websites

Rich company + technographic data

IP-to-company matching (Reveal)

Custom audience building for ads

Slack alerts for high-value account activity

Helpful for existing data cleanup and routing in HubSpot.

Pricing

Packaged inside HubSpot as credit-based plans

Pricing varies by volume and modules selected

No credit rollover (unused credits expire monthly)

Pros & Cons

Pros | Cons |

|---|---|

Seamless HubSpot integration | Requires HubSpot tenancy |

Strong for inbound lead scoring and workflows | Weak on verified phone/email data |

Reveal + Slack alerts help surface high-value accounts | No credit rollover |

What Real Users Say About Clearbit

Clearbit holds a 4.4/5 rating on G2, with feedback showing both strengths and limitations.

Some users highlight its marketing value. Thibaud D., Global Growth Marketing & CRM Manager (Mid-Market), shared:

“The all-in-one platform allows us to efficiently manage our email marketing, content, social media, and analytics in one place… The automation features (workflows) allow us to nurture leads effectively (AI native with Breeze) and structure a nice lead scoring.” (Source)

Others point to data issues. A Verified User in Computer Software (Enterprise) said:

“Easy integration into CRM… Lots of inaccuracies and duplicative data.” (Source)

The takeaway: Clearbit is a solid option if you’re already invested in HubSpot, but it’s less practical for teams that run outbound or need phone-verified contact data.

Bottom Line

Clearbit is a fit for marketing teams already tied into HubSpot and looking to enrich inbound leads. For outbound workflows that depend on verified phones and emails, other platforms are a better match.

6. Seamless.AI

Seamless.AI markets itself as an AI-powered discovery platform with one of the largest claimed databases of 1.3B contacts worldwide. The Chrome extension accelerates lead generation, but data coverage and contracts can be uneven.

Extras, like intent tracking and job-change alerts, make Seamless.AI more than a simple lookup tool.

The trade-off: accuracy is inconsistent across regions, contracts are opaque, and credits don’t roll over.

Who Should Use Seamless.AI

SDR-heavy teams that need constant new contacts in volume.

Companies experimenting with intent data and job-change triggers as part of their outreach.

Key Features

Claimed company profile database of 1.3B+ contacts

Chrome extension for LinkedIn + web scraping

Bulk list creation at scale

Buyer intent tracking and job-change alerts

Salesforce, HubSpot, Outreach integrations

“Unlimited user” offers at enterprise level

Some advanced features like job-change alerts and intent tracking add extra signals for prospecting.

Pricing

Free tier available for testing

Paid plans: typically $79+/user/month; enterprise custom

Credits governed by contract - no rollover

Pros & Cons

Pros | Cons |

|---|---|

Massive database (1.3B contacts) | Accuracy concerns by region |

Extras: intent + job-change alerts | No credit rollover |

Free tier to test before buying | Pricing opaque, contract-heavy |

Enterprise “unlimited user” offers | Aggressive sales tactics, extension stability issues |

What Real Users Say About Seamless.AI

Seamless.AI has a 4.4/5 rating on G2.

Some users value its speed and integrations. Ayan M., ServiceNow Consultant (Small Business), said:

“I really like how Seamless.AI helps me quickly find contact info for the people I want to reach out to… The Chrome extension makes it simple to use while browsing, and it works well with tools like Salesforce.” (Source)

Others point to accuracy and contract issues. A Verified User in Motion Pictures (Small Business) wrote:

“Seamless.ai failed us on two fronts: product and posture… results were underwhelming and the vaunted ‘intent’ search was practically unusable…” (Source)

The takeaway: Users like the speed and scale, but often get frustrated with accuracy gaps and rigid contracts.

Bottom Line

Seamless.AI is practical if you need massive lists and basic intent features. But if accuracy, compliance, or flexible contracts matter most, alternatives like FullEnrich and Cognism are more reliable.

7. RocketReach

RocketReach is a lightweight lookup tool built for sales and marketing teams. It claims access to 700M+ profiles, with solid email coverage but weaker phone accuracy. It is popular with recruiters for quick company data and contact information extraction.

It runs in the browser, with a Chrome extension and API that developers often use for integrations.

The trade-off: credits reset monthly with no rollover, and bulk usability can feel clunky compared to larger sales intelligence platforms.

Who Should Use RocketReach

Solo SDRs or recruiters who need quick contact lookups.

SMBs with smaller outbound needs.

Key Features

700M+ claimed profiles across industries

Browser extension for instant lookups

Bulk list processing for multiple contacts

API access for developer workflows

Global email reach with social profile links

Pricing

Essentials: ~$48–69/mo (tiered lookups)

Pro: ~$108–119/mo

Ultimate: ~$249/mo

No credit rollover — credits reset monthly

Pros & Cons

Pros | Cons |

|---|---|

Affordable vs enterprise platforms | Phone accuracy unreliable |

API + developer-friendly | No rollover - credits expire monthly |

Easy browser extension for fast lookups | Bulk UX can be clunky |

Global email reach + social data | Complaints about support and transparency |

What Real Users Say About RocketReach

RocketReach holds a 4.4/5 rating on G2, but reviews reflect both ease of use and customer frustrations.

Some users highlight its simplicity and CRM integrations. Chris W., Enterprise Account Executive (Mid-Market), said:

“RR is a really comprehensive tool for looking up the necessary contact information for cold outreach… It is very easy to learn and easy to use from day 1.” (Source)

Others report misleading pricing and poor support. A Verified User in Biotechnology (Mid-Market) shared:

“I signed up for RocketReach thinking I was getting unlimited contact lookups… Turns out, the Essentials plan only gives you 100 credits, something buried in the fine print… I absolutely would not recommend this tool based on how they treat new customers.” (Source)

The takeaway: Users agree it’s simple and affordable, but support and credit policies often disappoint.

Bottom Line

RocketReach is a great Cognism alternative if you need quick, low-cost lookups for emails and basic prospecting. But if accuracy, phone coverage, or flexible pricing are priorities, it may not hold up against other stronger alternatives. Good for fast lookups, less so for reliable phone numbers at scale.

8. Snov.io

Snov.io is a budget-friendly, all-in-one tool for lead generation, email discovery, verification, and outreach automation. It’s especially popular with startups because it combines prospecting, campaigns, and deliverability tools into one platform.

The limitations: phone coverage is weak, and only the Ultra plan includes credit rollover. Lower tiers expire monthly.

Who Should Use Snov.io

Bootstrapped startups or small SDR teams that rely on email.

Founders running email-first outbound campaigns.

Key Features

Email finder + 7-step email verification

Drip campaign automation and email warm-up

Chrome extension for LinkedIn + email capture

Integrations with Salesforce, HubSpot, Zapier

Rollover credits only on Ultra plan

Pricing

Starter: ~$29–39/mo (1,000 credits)

Pro: ~$74–99/mo (5,000 credits)

Only top tiers include rollover, so compare paid plans before committing.

Pros & Cons

Pros | Cons |

|---|---|

Very affordable compared to competitors | Weak phone coverage |

Includes outreach + warm-up tools | Credits expire monthly except Ultra |

7-step verification helps reduce bounces | UI less polished than larger platforms |

Chrome extension for LinkedIn capture | Data quality inconsistent |

What Real Users Say About Snov.io

Snov.io has a 4.6/5 rating on G2, though reviews highlight both benefits and drawbacks.

Some users praise its affordability and email suite. Akshat R., Senior Research Analyst (Mid-Market), said:

“Snov.io's suite of Email Finder, Email Verifier, and Email Tracker Extensions are the ultimate tools for seamless sales and recruitment outreach...” (Source)

Others complain about poor enrichment and service. Tim D. (Small Business) shared:

“Email enrichment provided a match of below 10%… Not worth it… No refund… Customer support ties you up in endless conversation instead of simply keeping a potential customer for future use.” (Source)

The takeaway: The reviews underline Snov.io’s value for affordable email workflows, but also its limits for reliable enrichment.

Bottom Line

Snov.io is a solid choice and cognism alternative for email-led teams that want prospecting and outreach in one tool without overspending. It’s not enterprise-grade, but for lean outbound strategies, it gets the job done.

9. LeadIQ

LeadIQ is a LinkedIn-first prospecting tool designed to speed up lead generation and SDR workflows. The Chrome extension lets reps capture contacts in one click and push them directly into Salesforce or Outreach, reducing manual data entry.

Its strength is workflow efficiency, not depth of data. Phone and email accuracy depends heavily on partners, and credits reset monthly with no rollover.

Who should use LeadIQ

SDR teams running LinkedIn-heavy outbound.

Sales orgs that want a lightweight add-on for Salesforce, Outreach, or Salesloft.

Key features

Chrome extension for LinkedIn contact capture

Job-change alerts to re-engage past prospects

Deduplication + tagging for cleaner CRM records

Tight integrations with Salesforce, Outreach, and Salesloft

Pricing

Free plan: 50 credits

Starter ~$45/user/month

Pro ~$89/user/month

Enterprise: custom pricing

No credit rollover — monthly resets apply

Pros & cons

Pros | Cons |

|---|---|

Intuitive Chrome extension | Limited coverage beyond LinkedIn |

Push-to-pipeline workflows | No credit rollover |

Strong Salesforce + sequencing tool integrations | Accuracy issues with phone/email data |

Clean CRM deduplication | Pricing rises quickly at scale |

What Real Users Say About LeadIQ

Rating: 4.2/5 on G2

Some users highlight how it streamlines LinkedIn prospecting. Dani L., Account Executive (Small Business), said:

“I like the ease of use and especially enjoy the plug ins where I can highlight a name and search their contact info all in one step…" (Source)

Others report issues with accuracy and usability. A Verified User in Telecommunications (Enterprise) shared:

“Wrong numbers given, sometimes no numbers or email info at all…” (Source)

The takeaway: Users agree LeadIQ improves LinkedIn prospecting workflows, but data accuracy and coverage limit it as a primary database.

Bottom Line

LeadIQ is best cognism alternative for SDR teams focused on LinkedIn and pipeline workflows. It saves time on manual data entry, but coverage gaps and accuracy issues make it less reliable than broader data providers.

10. UpLead

UpLead positions itself as the accuracy-first alternative with a 95% email accuracy guarantee and simple, transparent pricing. The platform includes direct dials, intent filters, and technographic data, but its extensive database is smaller than ZoomInfo or FullEnrich, especially for phone numbers.

It's still decent option if you value accurate contact information and simple pricing.

Who should use UpLead

Mid-market SDR teams that want accuracy-first enrichment.

Buyers who value published pricing over opaque sales quotes.

Key features

~50M+ contacts in database

95% accuracy guarantee with credit refunds on bounces

Direct dial numbers included

Intent signals and technographic filters

Salesforce, HubSpot, and Pipedrive integrations

Pricing

Free plan available

Essentials: $99/month (170 credits)

Plus: $199/month (400 credits)

Annual discount: $74/month (Essentials)

Credits expire monthly — no rollover

Pros & cons

Pros | Cons |

|---|---|

95% accuracy guarantee with refunds | Smaller database than ZoomInfo or FullEnrich |

Transparent, published pricing | Credits expire monthly with no rollover |

Direct dials included | Accuracy can vary by segment |

Clean UI + simple integrations | Higher entry price vs some budget tools |

What Real Users Say About UpLead

UpLead scores 4.7/5 on G2.

Some highlight its simplicity and integrations. Victoria R. (Small Business) wrote:

“Uplead is easy to use… Most of the info I’ve needed I’ve been able to find… It also links right to LinkedIn profiles…” (Source)

Others report ongoing data accuracy issues. A Verified User in Printing (Small Business) said:

“My sales people are saying most leads don’t have valid numbers… Inaccurate information. Phone numbers missing on a lot of leads.” (Source)

Reviews show UpLead wins points for simplicity and transparency, but struggles when teams need reliable phone coverage at scale.

Bottom Line

UpLead is a good cognism alternative if you want clear pricing and great contact data without enterprise contracts. But with a smaller database and no credit rollover, it’s less suited for teams that need global coverage or extensive mobile data.

11. Clay

Clay is an enrichment and workflow platform built for ops-savvy teams. Instead of relying on a single database, Clay connects to multiple data sources and lets you design custom enrichment “recipes” inside a spreadsheet-like interface.

So, it's great when you want unrestricted access to multiple data providers through one workspace.

The trade-off: it’s powerful but takes more effort to set up, with a steeper learning curve than plug-and-play tools. Credit costs add up fast, even with rollover.

Who should use Clay

RevOps teams that want to build custom enrichment workflows.

Agencies managing multiple client ICPs.

Key features

Spreadsheet-style interface with “rows” and “recipes”

Pull data from multiple APIs (Clearbit, Apollo, etc.)

AI transforms for cleaning, deduplication, and personalization

Integrations with Salesforce, HubSpot, Outreach, Zapier

Credits roll over up to 2× monthly cap

Powerful advanced search capabilities to chain data steps.

Pricing

Starts at $149/month

Credits roll over up to 2× the monthly limit

Pros & cons

Pros | Cons |

|---|---|

Flexible — connect multiple providers | Steeper learning curve for new users |

Credit rollover reduces waste | Data accuracy depends on connected sources |

Strong fit for agencies and RevOps teams | Credits can burn quickly, raising total cost |

Powerful customization for workflows | Higher base price than entry-level tools |

What Real Users Say About Clay

Clay has a 4.8/5 rating on G2

Qais B., Growth Strategist (Mid-Market), said:

“Enrich your contacts from numerous sources and level up your responses by 40%… Get the best data providers at one subscription and save up to 70% costs.”

They added:

“A new user can never figure out what to do on Clay… Chances of credits getting misused for wrong operations are high… Credits per cost are too low for a team to work on.” (Read the full review here)

This review highlight Clay’s dual reality: powerful for advanced users, but overwhelming for beginners and costly if workflows aren’t set up carefully.

Bottom Line

Clay is best for teams that want to customize their enrichment stack and consolidate multiple providers. If you’re willing to put in the effort, it offers flexibility few other tools can match.

12. Dealfront

Dealfront is an EU-focused sales intelligence platform built on local providers like Echobot and Leadfeeder. Its strength is in DACH and Benelux markets, with GDPR-compliant data sourcing and features like website visitor identification that link inbound signals to outbound activity.

The drawback: limited US/global coverage, custom-only pricing, and no credit rollover.

Who should use Dealfront

EU-based sales and marketing teams under strict GDPR rules.

Companies that need visitor ID connected to outbound workflows.

Key features

Built on German/EU sources (Echobot + Leadfeeder)

Strong DACH and Benelux coverage

Website visitor ID (similar to Clearbit Reveal)

Salesforce + HubSpot integrations

Export quotas by module (credits expire monthly)

Pricing

Starts at €99+/month for modules

Enterprise bundles run €10k–30k/year

Credits/export tied to contracts (no rollover)

Pros & cons

Pros | Cons |

|---|---|

Excellent EU and DACH coverage | Custom pricing only |

GDPR-native compliance | Limited US/global coverage |

Adds visitor ID to outbound workflows | Not budget-friendly |

Intuitive interface, helpful support (reported) | Integrations weaker than peers |

What Real Users Say About Dealfront

Dealfront has a 4.5/5 rating on G2, though reviews highlight both strengths and pain points.

Some users value the strong EU data and ease of use. Tobias A. (Mid-Market) wrote:

“Due to the large database in the DACH region and the easy-to-use filters… The user interface is very intuitive and easy to use. New colleagues can start without extensive training.” (Source)

Others report major issues with support and operations. A Verified User in Financial Services (Mid-Market) shared:

“They keep sending spam emails… Their support is completely oblivious and they don’t have a working system… Even after paying, we are still receiving emails from them. Their support asked us to just ignore them.” (Source)

The pattern: trusted for EU coverage and compliance, but frustrations with support and integration quality show up in reviews.

Bottom Line

Dealfront is the GDPR-native option for EU-first companies and marketing teams. If compliance and local coverage are top priorities, it’s a strong pick. But if you need global data or more reliable support, other platforms may be a better fit.

Why FullEnrich Is the Best Cognism Alternative

1. Broader Global Coverage

Cognism is strongest in the EU, but its data coverage outside that region can be inconsistent. FullEnrich solves this with a waterfall enrichment process that pulls from 20+ premium providers across the US, EU, APAC, and niche industries.

This multi-vendor approach consistently delivers 85%+ match rates, ensuring your team gets verified data whether you’re targeting DACH, North America, or emerging markets.

2. Flexible Credit System

Cognism uses a strict “use-it-or-lose-it” monthly policy. If your team doesn’t use all credits, they expire at the end of the cycle - wasting budget.

FullEnrich gives you a 3-month rollover, so credits align with your actual pipeline activity. Plans start at $29/month with transparent pricing, making it far more flexible for SDR and RevOps teams.

That’s true flexible pricing plans without surprises.

3. Triple-Verified Accuracy

Cognism relies on a single database, which can lead to gaps and outdated contact details. FullEnrich triple-verifies every email and prioritizes mobile numbers over switchboards, keeping bounce rates below 1%, and preventing outdated or incorrect information from clogging campaigns.

That accuracy protects your sender reputation and helps SDRs spend more time on live connects, not chasing bad data.

4. Designed for Team Workflows

Cognism requires long contracts and focuses on data access alone. FullEnrich is built for modern sales teams: CSV uploads, real-time API enrichment, and integrations with Salesforce, HubSpot, Clay, and Zapier.

Plus, unlimited seats mean your whole team can use the platform without paying per-user fees. It also reduces manual data entry through CRM integration and APIs.

FullEnrich beats Cognism on coverage, accuracy, and pricing flexibility. It’s the better choice for sales and marketing teams that want predictable costs, global reach, and verified contact data without the contract lock-ins.

👉 See the difference for yourself: try FullEnrich with 50 free credits or book a demo to compare results head-to-head.

Cognism Alternatives: FAQs

Who are Cognism competitors?

Cognism competes with other B2B data providers like FullEnrich, Apollo.io, ZoomInfo, Lusha, Dealfront, Clay, Seamless.AI, UpLead, RocketReach, LeadIQ, and Snov.io.

These tools all help sales teams find verified emails and mobile numbers, but they're different in focus: FullEnrich uses a multi-source waterfall, Apollo bundles data + sequences, ZoomInfo dominates in the US, and Dealfront focuses on EU compliance. Most position themselves as a sales intelligence platform for lead generation, but their strengths differ by data coverage and tools.

What is the difference between Cognism and Lemlist?

The difference is that Cognism is a data provider, while Lemlist is an email outreach tool. Cognism gives you verified contact details (emails, phone numbers, company info). Lemlist helps you send and personalize cold email campaigns. Pairing both is common for sales efforts where data feeds the sequencer.

What is the difference between Kaspr and Cognism?

Kaspr is a LinkedIn Chrome extension for quick email and phone lookups. It’s lighter, cheaper, and aimed at individual SDRs or small teams. Cognism is a larger enterprise data platform, with deeper EU coverage, compliance guarantees, and bigger contracts. Kaspr = fast and simple. Cognism = deeper, broader, but pricier.

What is the difference between Lusha and Cognism?

Lusha is a SMB-friendly tool with Chrome extension, self-serve pricing, and credit rollover. It’s easy to use for LinkedIn-based prospecting. Cognism is more enterprise/EU-focused: stronger compliance features, larger datasets, better customer support, but credits expire monthly and pricing is custom. Lusha = affordable and quick. Cognism = compliant and enterprise-ready.

Other Articles

Cost Per Opportunity (CPO): A Comprehensive Guide for Businesses

Discover how Cost Per Opportunity (CPO) acts as a key performance indicator in business strategy, offering insights into marketing and sales effectiveness.

Cost Per Sale Uncovered: Efficiency, Calculation, and Optimization in Digital Advertising

Explore Cost Per Sale (CPS) in digital advertising, its calculation and optimization for efficient ad strategies and increased profitability.

Customer Segmentation: Essential Guide for Effective Business Strategies

Discover how Customer Segmentation can drive your business strategy. Learn key concepts, benefits, and practical application tips.