Published on

Updated on

You're staring down two wildly different approaches to B2B prospecting data. One promises enterprise-grade GTM orchestration with AI Copilot and dynamic territories at a price tag that'll make your CFO wince.

The other delivers triple-verified contacts and Bombora intent for less than your monthly coffee budget.

Here's the uncomfortable truth: ZoomInfo and Lead411 aren't really competing for the same buyers. ZoomInfo targets enterprises willing to drop $25,000+ annually for a comprehensive GTM platform.

Lead411 appeals to scrappy teams that need verified emails and phone numbers without the enterprise tax. Both lock you into single-source data limitations that can torpedo your find rates when their coverage has gaps.

In this article, we'll break down exactly what you're paying for, which platform wins specific categories (spoiler: different tools excel at different things), and where both fall short.

We'll also introduce FullEnrich—that's us!—as a third option when pure enrichment accuracy matters more than workflow orchestration.

Let's dig in. 🎯

What is ZoomInfo?

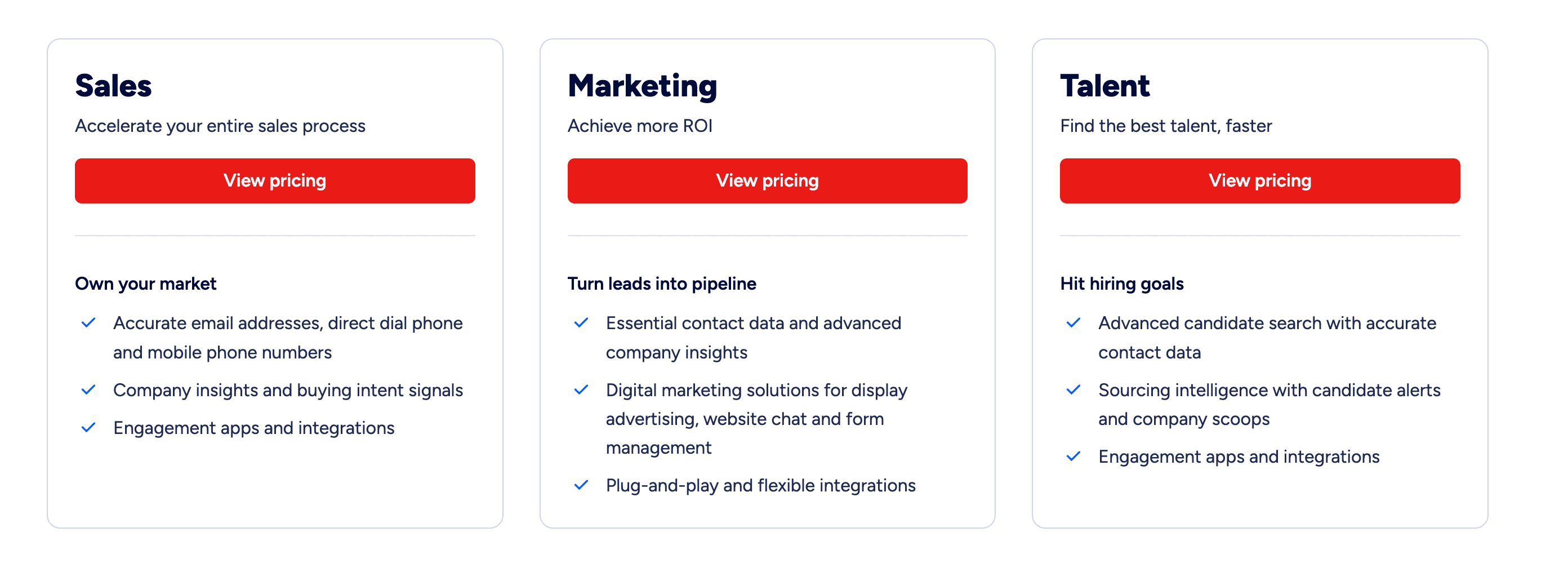

ZoomInfo is the enterprise GTM intelligence platform that combines contact database, AI-powered workflows, and sales orchestration into one comprehensive suite.

From my experience, it's built for large revenue teams that need org charts, buying committee mapping, and deep CRM integrations—assuming you can navigate the opaque pricing and steep learning curve.

What is Lead411?

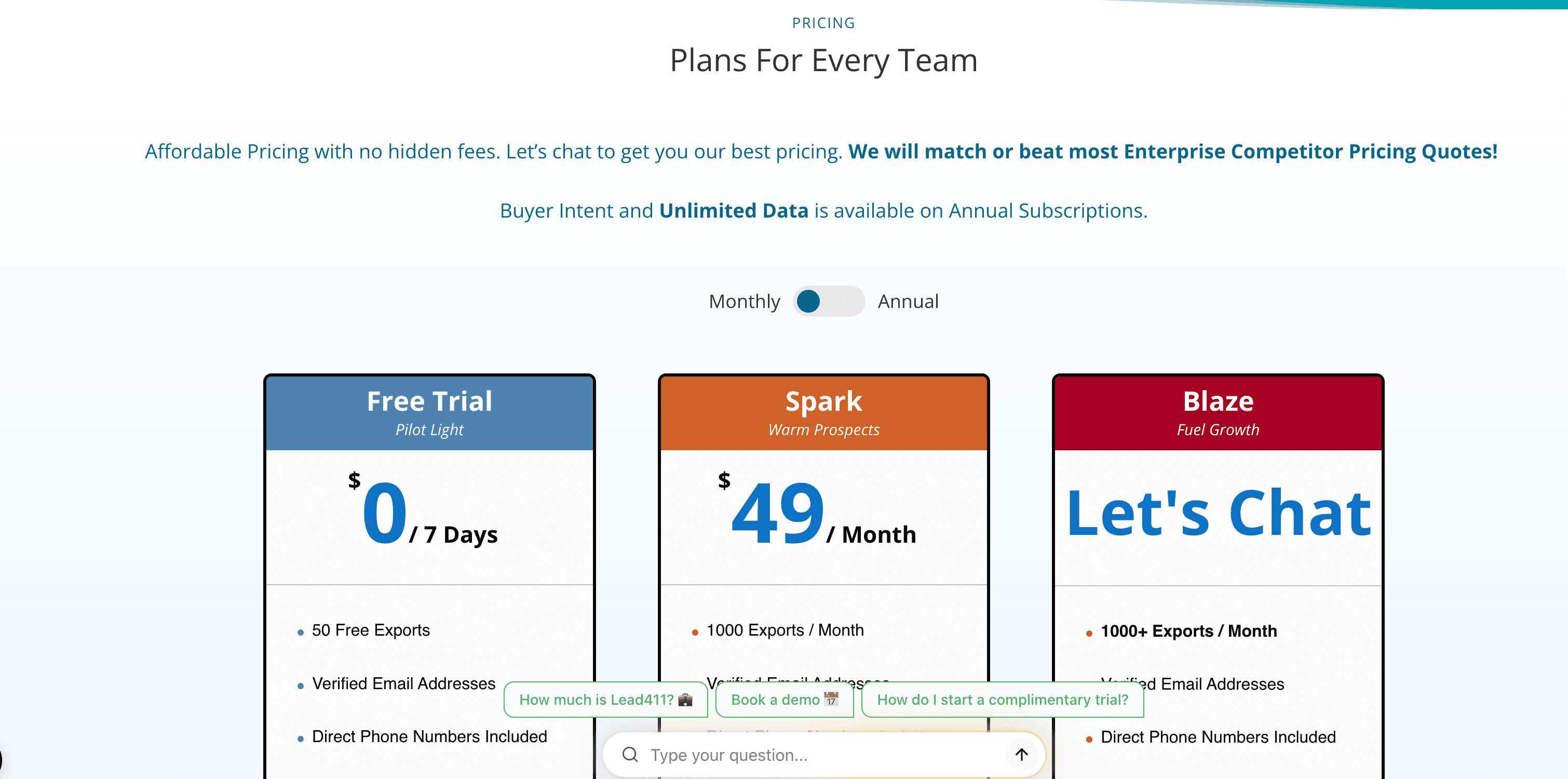

Lead411 focuses on one thing: verified B2B contact data that works. They triple-verify emails, double-verify phone numbers, and throw in Bombora intent signals on annual plans—all starting at $49/month.

It's the no-frills approach for teams that just need accurate contact data without paying for features they'll never use.

What is FullEnrich?

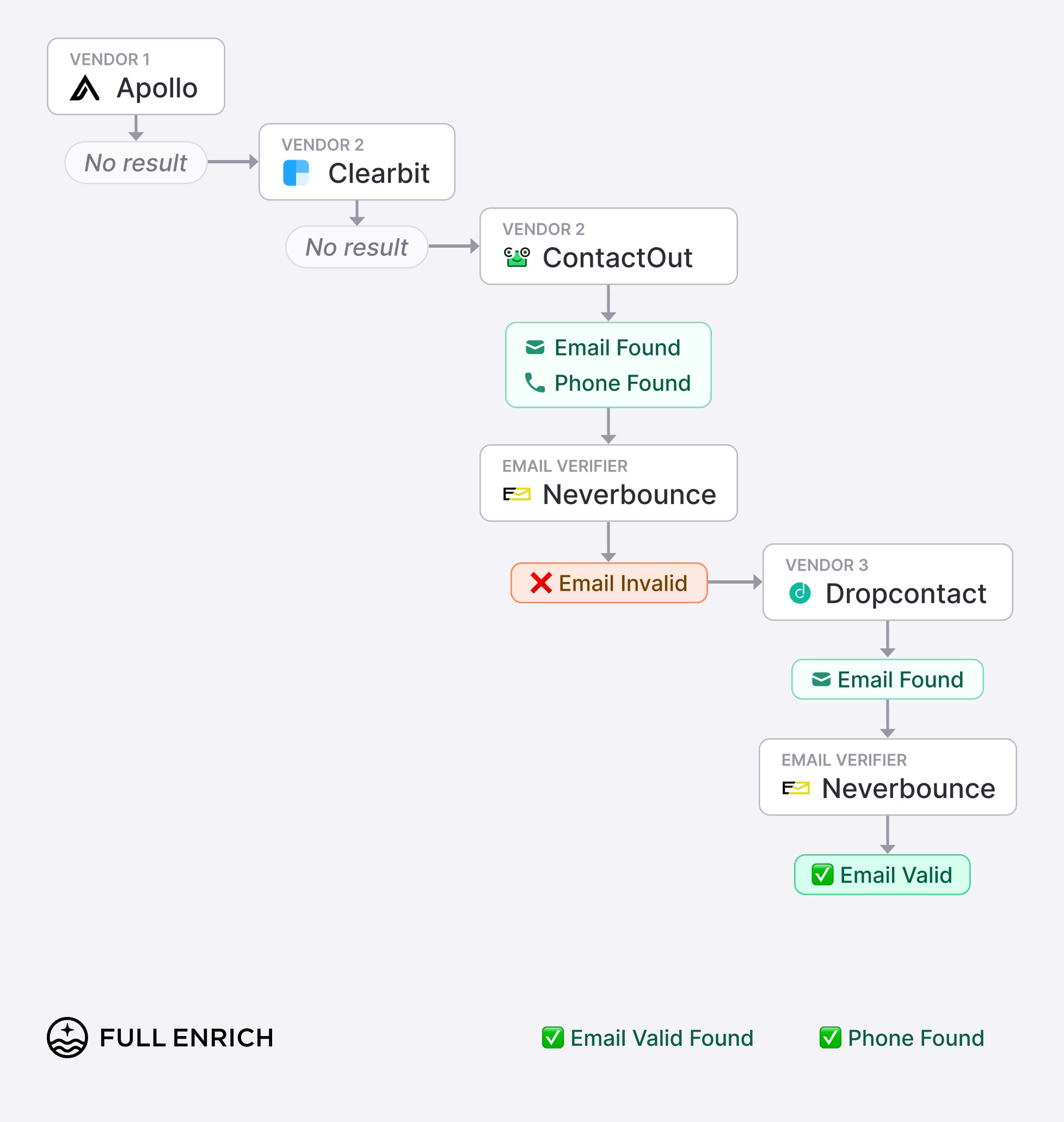

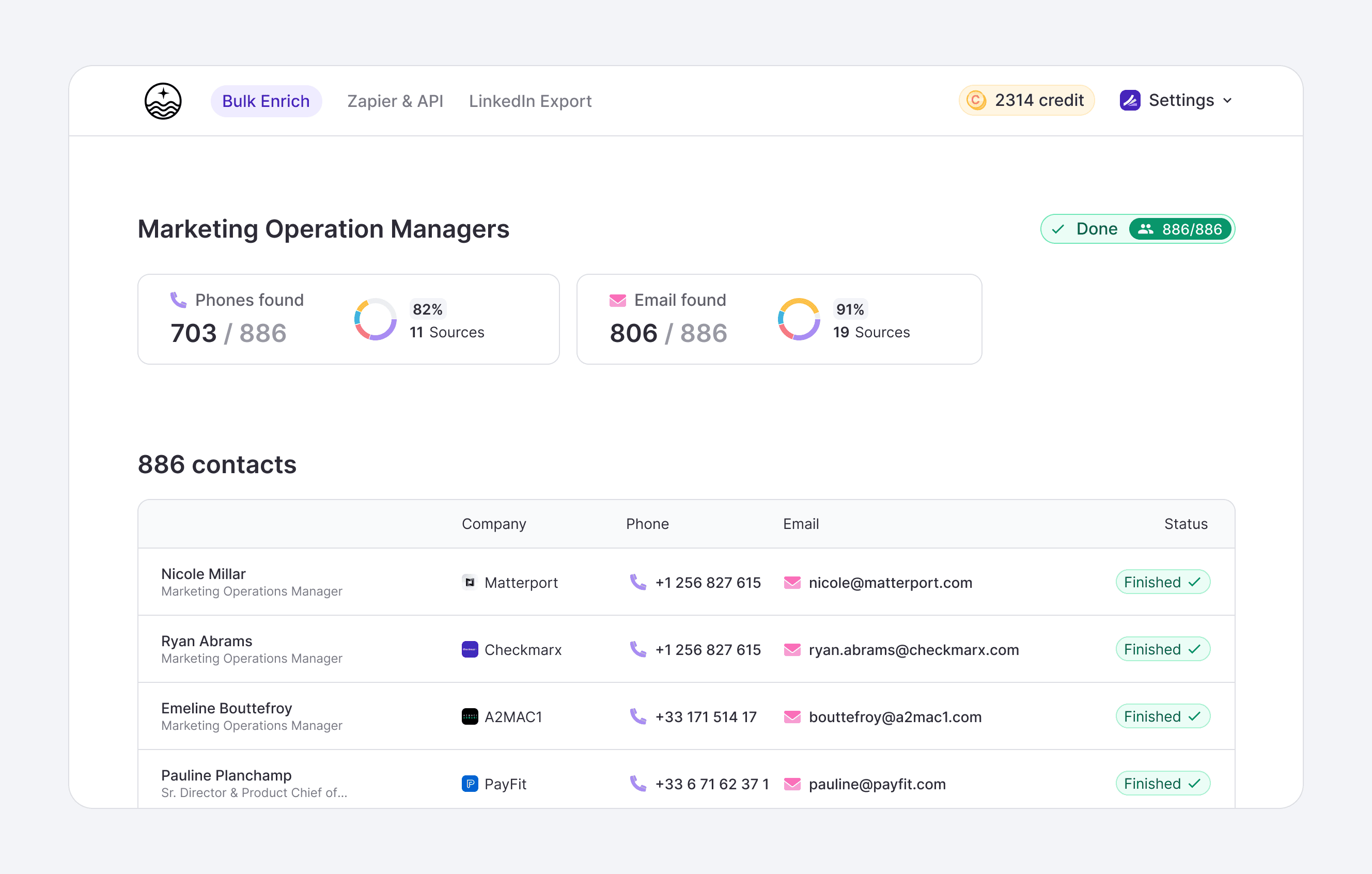

FullEnrich (that's us!) takes a different approach entirely: waterfall enrichment across 20+ premium data vendors. Instead of betting on one provider's coverage, we aggregate the best sources and only charge credits when we actually find valid contacts.

Starting at $29/month with pay-on-success pricing, we're built for sales and marketing teams that prioritize find rates and data accuracy to improve lead generation process over GTM orchestration.

Lead411 vs Zoominfo: Quick Comparison

Feature | ZoomInfo | Lead411 | FullEnrich |

|---|---|---|---|

Starting Price | ~$25,000/year (quote-based); Free Lite tier ~10 downloads/month | $49/month; $490/year with intent | $29/month with pay-on-success credits |

Free Trial | ZoomInfo Lite (limited) | 7-day trial, 50 exports | 50 free contact enrichments |

Data Approach | Single proprietary database | Single verified database | Waterfall across 20+ sources |

Find Rate | Varies by industry/role | ~96% deliverability claim (US-focused) | ~80% with <1% bounce rate |

Key Strength | Enterprise GTM orchestration | Verified contacts + intent at budget price | Multi-source coverage, mobile numbers |

Main Limitation | Complex UI, opaque pricing, credit caps | Limited advanced features, US-focused | Pure enrichment (no prospecting/workflow tools) |

Best For | Enterprise teams with ops resources | Budget-conscious US outbound teams | Teams needing accurate enrichment at scale |

Compliance | CCPA, GDPR, ISO 27701 | Not documented | SOC 2 Type II, GDPR, CCPA |

Looking beyond Zoominfo and Lead411? There are some Zoominfo alternatives or Lead411 alternatives like FullEnrich worth exploring.

1. Data Quality & Accuracy

Let's start where it actually matters: will the contacts you pull actually bounce, or will they deliver? Both ZoomInfo and Lead411 promise clean data, but their approaches—and results—differ dramatically.

Metric | ZoomInfo | Lead411 | FullEnrich |

|---|---|---|---|

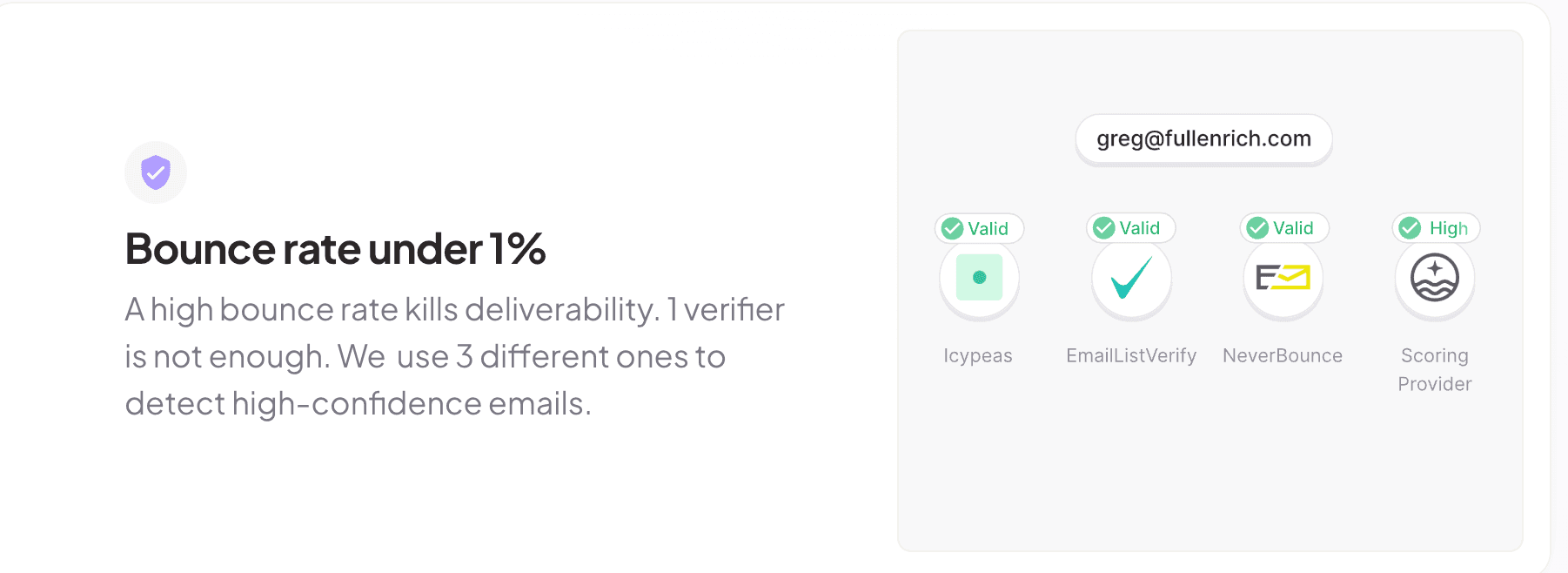

Verification Process | Proprietary cleaning | Triple-verified emails, double-verified phones | Triple verification across sources |

Re-verification Frequency | Not specified | Every 3-6 months | Real-time via waterfall |

Deliverability Claim | "Clean & compliant" | 96% under specified conditions | <1% bounce rate |

Coverage Type | Global, all industries | US-focused, business contacts | Global via 20+ vendors |

Find Rate | Varies widely | Strong for US contacts | ~80% across regions |

Mobile Numbers | Available but gaps reported | Double-verified direct dials | Specialized mobile coverage |

ZoomInfo: Enterprise Data with Caveats

ZoomInfo's database is massive, and their firmographic/technographic data genuinely impresses when you're building complex target lists.

The Lead Builder lets you filter by tech stack, employee count, revenue, and buying signals in ways that feel powerful.

Here's the catch: user reviews consistently mention outdated contacts, stale job titles, and phone numbers that ring to confused former employees.

The data quality varies wildly by industry and seniority level. What ZoomInfo does well is scale—when you need thousands of records fast, they deliver.

Lead411: Verification-First Philosophy

From my experience, Lead411's approach works better for targeted campaigns. Their triple-verification process (SMTP validation + human verification + open validation) gets re-verified every 3-6 months.

Phone numbers undergo double verification including location matching. They're confident enough to claim 96% deliverability—bold in an industry where 85% is considered solid.

The trade-off? You're getting fewer total contacts than ZoomInfo's database.

But for sales teams running focused outbound where every dial matters, that emphasis on verification over volume makes sense. Just know their US-focused dataset means international coverage takes a hit.

FullEnrich: The Multi-Source Solution

Here's what we built: Instead of forcing you to choose one vendor's coverage, we aggregate 20+ premium sources in real-time. When ZoomInfo doesn't have that mobile number or Lead411 lacks European coverage, our waterfall approach fills the gaps automatically.

From our testing, we're hitting ~80% find rates with bounce rates under 1%. Credits only get consumed on successful finds—no paying for missing data or outdated records.

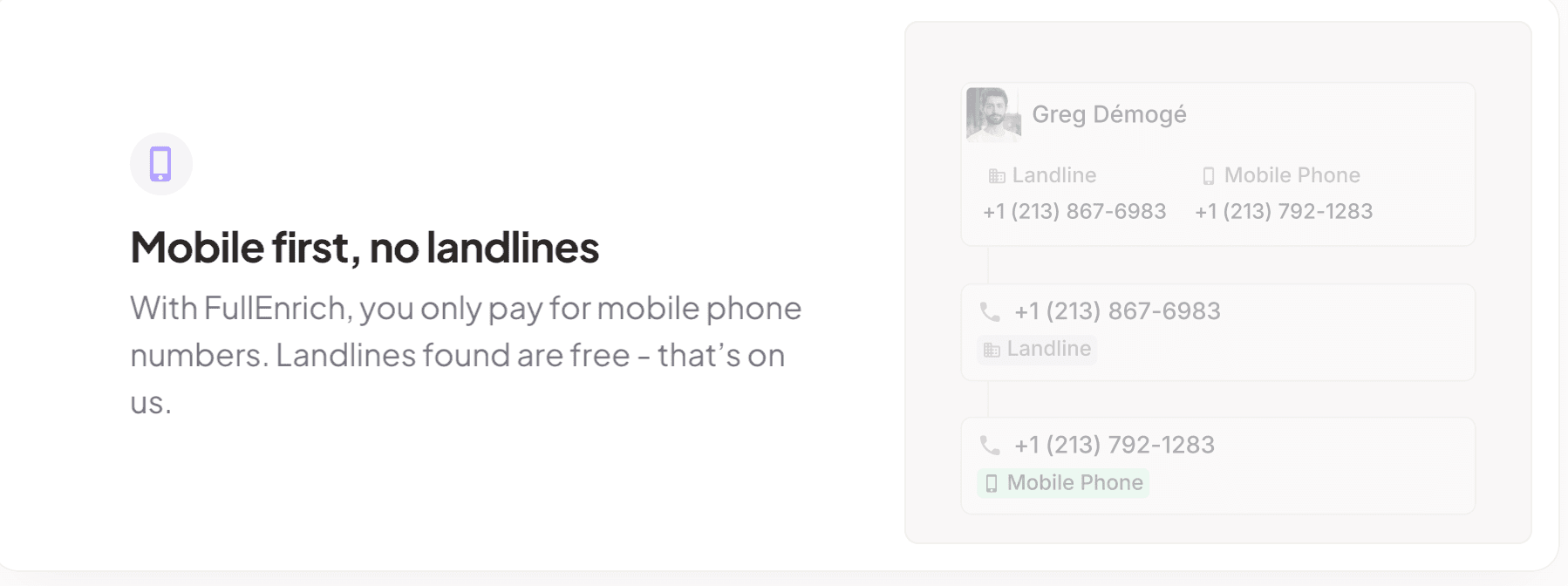

We also specialize in mobile phone numbers with landlines included free, solving the direct dial problem both competitors struggle with.

The trade-off? We're pure enrichment. You won't get org charts, intent signals, or prospecting workflows. But if your primary need is accurate email and mobile data at scale—especially across geographies—our multi-source approach outperforms single-vendor limitations.

Ready to test the difference? Get 50 contacts enriched free and compare our waterfall find rates to your current provider. No credit card required.

Verdict on data quality

🥇 Winner for Data Quality: FullEnrich (~80% find rate with <1% bounce through multi-source waterfall beats single-vendor coverage gaps)

🥈 Second Place: Lead411 (Triple verification and 96% deliverability claim delivers reliable US contacts)

🥉 Third Place: ZoomInfo (Scale and filtering power offset by user reports of outdated records)

2. Key Features

Let's be honest—ZoomInfo and Lead411 aren't even playing the same game. One's a full GTM platform with AI workflows, the other's a verified contact database with intent signals. The question isn't which has more features—it's which features you'll actually use.

Feature Category | ZoomInfo | Lead411 | FullEnrich |

|---|---|---|---|

AI/Automation | AI Copilot, guided selling | Basic Reach sequences | API-first, automation-ready |

Search & Filtering | Highly customizable Lead Builder | Simple, effective filters | N/A (enrichment only) |

Org Intelligence | Org charts, buying committees | Basic company data | N/A |

Intent Signals | Multiple tiers | Bombora (annual plans) | N/A |

Data Exports | Credit-based with caps | 1K-unlimited by tier | Pay-per-success credits |

Mobile Coverage | Available with gaps | Double-verified direct dials | Specialized mobile focus |

API Access | Enterprise tiers | Available | Native API-first design |

ZoomInfo: The GTM Orchestration Beast

ZoomInfo's AI Copilot isn't marketing fluff—it actually guides reps through personalized sequences and automates prospecting grunt work.

The Lead Builder lets you slice data by firmographics, technographics, and intent in ways Lead411 can't touch.

You get

org charts showing decision-maker relationships,

lead routing that auto-distributes accounts by rep capacity

dynamic territories that adjust automatically.

Where ZoomInfo shines is complex workflow orchestration.

Your RevOps team can build automation rules triggered by intent spikes, technographic changes, or engagement thresholds. It's legitimately powerful.

Here's the truth bomb: most teams use maybe 20% of these capabilities. The complexity overwhelms smaller orgs that just need accurate contacts.

And all those features don't help when the underlying contact data has gaps.

Best for: Enterprise teams with dedicated ops resources who'll actually leverage advanced GTM orchestration.

Lead411: Focused on What Actually Matters

Lead411 strips away the complexity and focuses on:

verified contacts with buying signals.

Every email gets triple-verified (SMTP + human + open validation), then re-verified every 3-6 months.

Phone numbers get double verification including location matching—resulting in that 96% deliverability claim.

The killer feature for budget teams? Bombora intent data comes included with annual Spark ($490/year) and Pro plans.

No expensive add-on required. You also get sales intelligence alerts for funding rounds, hiring sprees, and executive changes.

Some annual plans include unlimited exports with rollover—no daily caps burning holes in your prospecting workflow.

It's not a full GTM suite, but for teams needing verified contacts with intent signals, it delivers the essentials without the bloat.

Best for: Teams that need core prospecting data with intent signals, minus the enterprise overhead.

FullEnrich: Enrichment at Scale

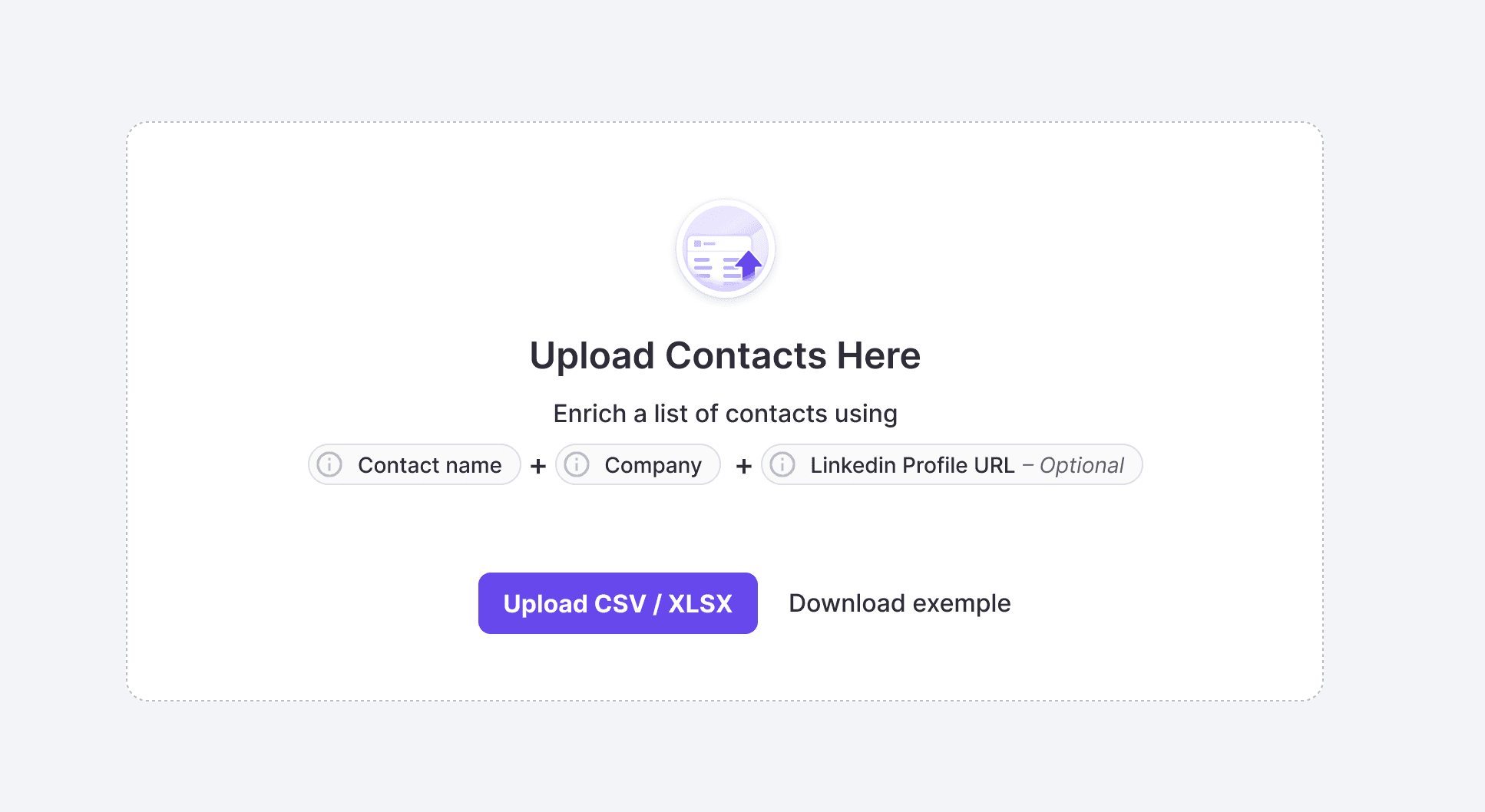

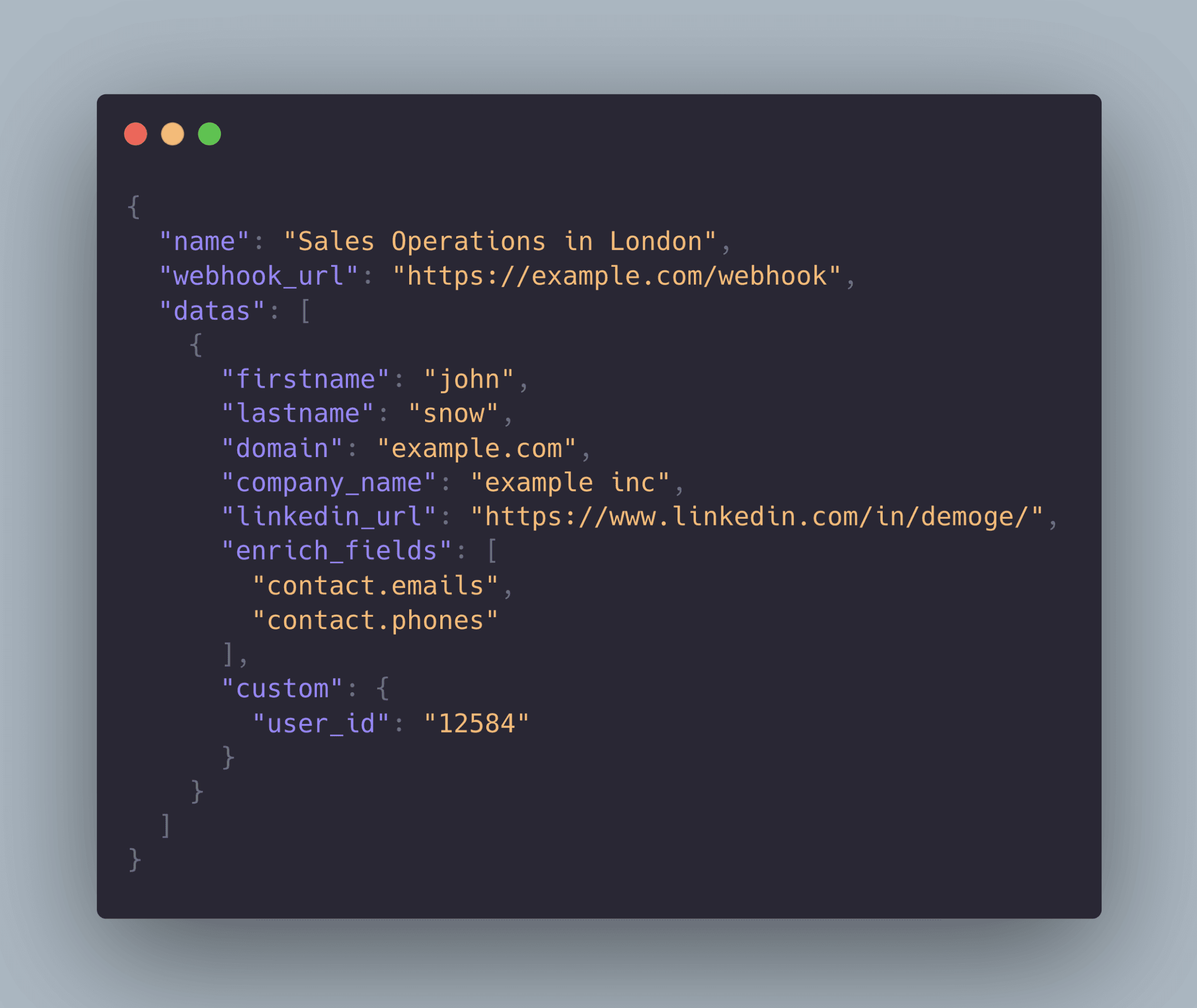

What we built:

A dead-simple platform that works however you work

Upload CSVs through our clean web UI, export directly from LinkedIn Sales Navigator (up to 2,500 at once)

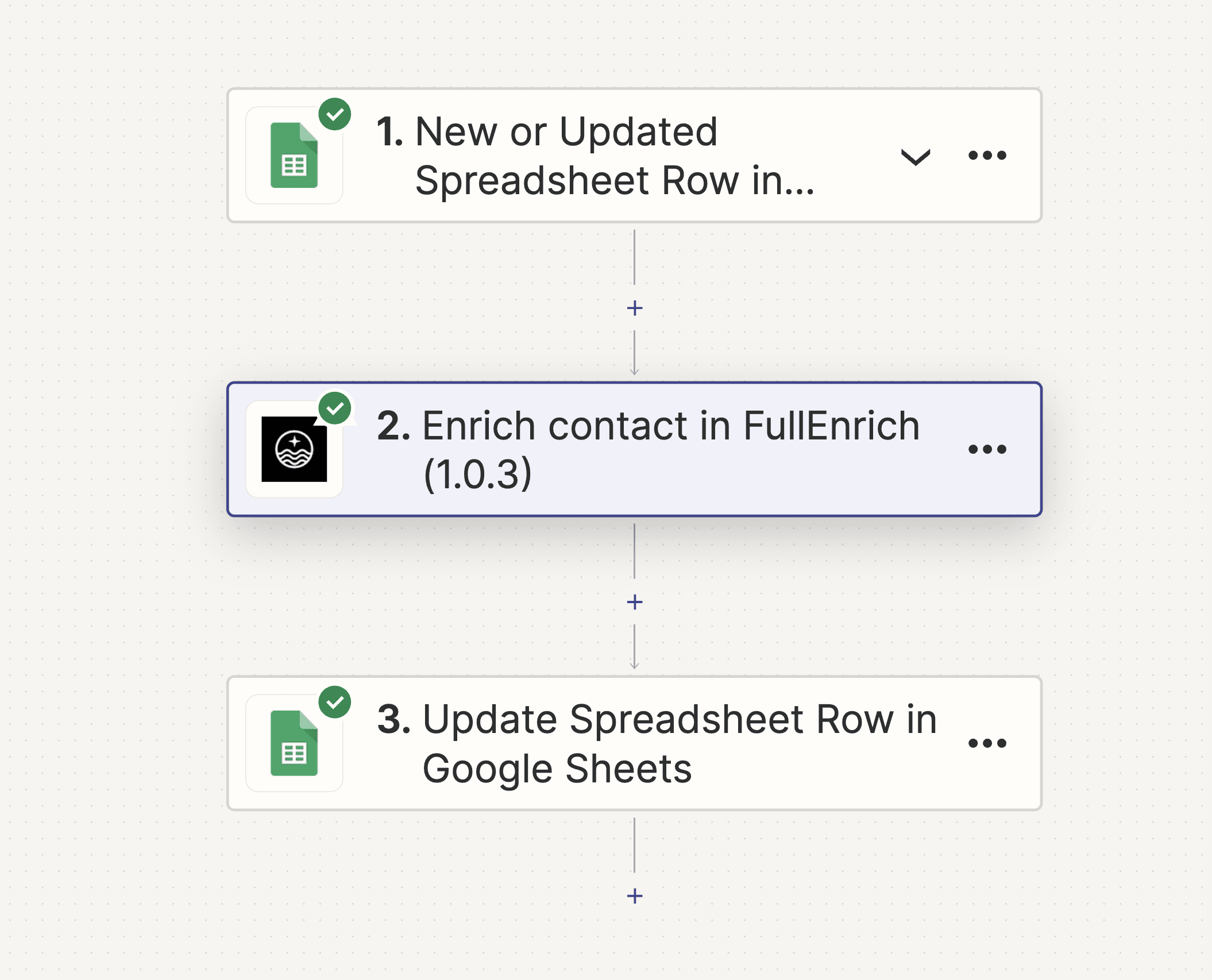

integrate via our powerful API with Clay, Make, Zapier, and n8n.

We waterfall across 20+ vendors to maximize find rates and charge credits only on successful enrichments—no paying for misses.

Credits roll over for three months and share across your team—no racing the clock.

We won't replace ZoomInfo's GTM orchestration or Lead411's intent signals. But whether you prefer uploading CSVs through our UI or building automated workflows through our API, we outperform both on coverage and unit economics for pure enrichment.

Verdict on Features

🥇 Winner for Features: ZoomInfo (Comprehensive GTM platform with AI, org charts, and enterprise workflows)

🥈 Second Place: Lead411 (Verified contacts + Bombora intent at budget pricing hits the sweet spot for focused teams)

🥉 Third Place: FullEnrich (Pure enrichment means no prospecting/workflow features, but API-first design integrates anywhere)

3. Pricing & Contracts

Let's talk about what you'll actually pay—not what the sales deck promises. ZoomInfo and Lead411 take opposite approaches to pricing, and the difference could make or break your budget.

Pricing Aspect | ZoomInfo | Lead411 | FullEnrich |

|---|---|---|---|

Transparency | Quote-based, opaque | Public pricing, clear tiers | Public pricing, clear credits |

Starting Cost | ~$25,000/year (reported) | $49/month or $490/year | $29/month |

Free Tier | Lite (~10 downloads/month) | 7-day trial, 50 exports | 50 free enrichments |

Contract Terms | Annual, difficult to cancel | Monthly or annual options | Monthly or annual, flexible |

Hidden Costs | Credit caps, verification fees | Export limits on lower tiers | None—pay only on success |

Rollover/Sharing | No | Yes (exports roll over) | Yes (3-month rollover, team sharing) |

Price Match | Not offered | Yes, plus contract buyout | N/A |

ZoomInfo: The Enterprise Tax

ZoomInfo operates on quote-based pricing that's as opaque as it gets. Their free ZoomInfo Lite tier limits you to around 10 downloads monthly—barely enough to test the platform.

ZoomInfo has three main plans

Professional (~$15,000/year)

Advanced (~$24,000/year)

Elite ($40,000+/year).

The real frustration? Hidden costs that users consistently complain about. You might sign thinking you have enough credits, only to discover daily caps, verification fees, or enrichment add-ons that weren't disclosed.

Several reviews mention difficult contract terms that lock you in with little flexibility when the platform underdelivers.

👉 To learn more about Zoominfo pricing

Best for: Enterprises with six-figure budgets and legal teams to review contracts.

Lead411: Transparent Value

Lead411 keeps it refreshingly simple:

$49/month for Spark (1,000 exports) or

$490/year for annual Spark with 12,000 exports plus Bombora intent.

Need unlimited exports? Their annual Blaze plan delivers exactly that. The pricing is public, predictable, and doesn't require negotiating with sales to understand.

What makes Lead411 buyer-friendly? Monthly plans cancel anytime on certain tiers. Unused exports roll over.

They'll even buy out competitor contracts or match pricing quotes. It's the anti-enterprise approach—no hidden fees, no surprise charges.

👉 To learn more about Lead411 pricing

Best for: Teams that hate vendor lock-in and need predictable, transparent pricing.

FullEnrich: Pay Only for What Works

Why we built this model: Traditional providers charge whether they find data or not. We only consume credits on successful enrichments.

Starting at $29/month, you get access to 20+ sources through waterfall enrichment—but you only pay when we actually deliver valid contacts.

Starter Plan: $29/month for 500 credits

Pro Plan: $55/month for 1,000 credits

Enterprise: Custom pricing from $400-$50K/month

Credits roll over for three months and share across your team. No racing against monthly caps. No penalties for unused allocation. It's pricing that aligns vendor success with yours.

👉 To learn more about FullEnrich pricing

The catch? You're enriching existing lists, not discovering new prospects. But for teams that already have lead sources and need maximum enrichment accuracy, our unit economics often beat both ZoomInfo and Lead411.

Test it yourself: Enrich your first 50 contacts free and see how pay-on-success pricing compares to traditional credit systems.

Verdict on Pricing

🥇 Winner for Pricing: Lead411 ($49/month transparency with Bombora intent at $490/year beats ZoomInfo's opacity—even if FullEnrich offers better unit economics)

🥈 Second Place: FullEnrich ($29/month pay-on-success with 3-month rollover delivers better value than enterprise contracts)

🥉 Third Place: ZoomInfo (~$25,000+ annual costs with hidden fees and credit caps frustrate even enterprise buyers)

4. Ease of Use & Support

Here's a truth bomb: the best dataset in the world is worthless if your team won't use it. Time-to-productivity matters more than your feature checklist, and interface friction tanks adoption faster than bad data ever could.

User Experience Factor | ZoomInfo | Lead411 | FullEnrich |

|---|---|---|---|

G2 Ease of Setup | Not prominently featured | 9.2 out of 10 | Fast API integration |

Learning Curve | Steep, weeks to productivity | Under an hour for basic use | Minutes for API setup |

Interface Complexity | Complex, "convoluted" per users | Simple, intuitive | API-first (minimal UI) |

Onboarding Quality | "Unpleasant" per some reviews | Quick, straightforward | Self-service with docs |

Support Channels | Multiple, but tier-based priority | Round-the-clock, responsive | Dedicated support + Help Center |

Documentation | Extensive but complex | Clean, accessible | Comprehensive API docs |

ZoomInfo: Power at the Cost of Complexity

ZoomInfo packs enterprise capabilities into its platform, but users consistently report paying for that power with complexity.

The interface is described as "convoluted" with a steep learning curve that frustrates new users and slows even experienced teams. Expect weeks of onboarding before your reps hit full productivity.

The Lead Builder offers incredible customization, but that flexibility comes with a maze of filters that can overwhelm SDRs who just need qualified contacts quickly.

Multiple users report an "unpleasant onboarding experience," and the learning curve isn't just steep—it's ongoing as new features roll out.

If you're running a lean team without dedicated ops support, factor in significant ramp-up time and potential adoption resistance.

Best for: Enterprises with full-time admins and extensive training resources.

Lead411: Simplicity That Drives Adoption

Lead411's 9.2 ease-of-setup score on G2 isn't marketing fluff. The interface is refreshingly simple—you can train a new SDR in under an hour.

Everything you need is exactly where you'd expect it. No hidden menus. No complex navigation trees.

The Chrome extension deserves special mention—it integrates seamlessly into your browsing workflow for pulling verified contacts directly from LinkedIn or company sites.

You won't get ZoomInfo's deep customization, but most teams find Lead411's straightforward filters more than sufficient for daily prospecting.

The trade-off is clear: immediate productivity over advanced capabilities.

Best for: Teams that need reps productive from day one, not month three.

FullEnrich: Simple UI Meets Powerful API

Our approach: We built both a dead-simple web interface and a powerful API because different teams work differently. Upload your CSV, click enrich, export results—it takes minutes, not hours.

With a 9.2 ease-of-use score matching Lead411's, users consistently praise how FullEnrich doesn't try to replace their CRM or force complex workflows. Export directly from bulk enrich spreadsheets through our clean UI, or integrate via API with Clay, Make, Zapier, or n8n for automated workflows.

For technical teams, our API documentation is comprehensive and actually helpful. For non-technical teams, the web interface requires zero training. Setup takes minutes either way, and enrichment happens in real-time.

Support-wise, we maintain a dedicated team and comprehensive Help Center. Customer feedback consistently praises our responsiveness—you're talking to people who actually want to help, not tier-based support queues.

Test it yourself: Enrich your first 50 contacts free and see how pay-on-success pricing compares to traditional credit systems.

Verdict on UX

🥇 Winner for Ease of Use: Lead411 (9.2 G2 ease score and under-an-hour training delivers immediate team productivity)

🥈 Second Place: FullEnrich (9.2 G2 ease score with simple UI for CSVs plus API flexibility serves both technical and non-technical teams)

🥉 Third Place: ZoomInfo (Weeks-long learning curve and "convoluted" UI delay ROI despite powerful capabilities)

5. Integrations & Workflow

The best dataset in the world is worthless if your reps can't access it where they actually work. Integration quality drives adoption more than any feature checklist.

Integration Factor | ZoomInfo | Lead411 | FullEnrich |

|---|---|---|---|

CRM Integrations | Salesforce, HubSpot, Marketo (native) | Salesforce, HubSpot (native) | HubSpot 2-way sync, Salesforce (early access) |

Sales Tools | Outreach, SalesLoft, Gong (native) | Outreach, Chrome extension | Outreach, Salesloft (early access) |

Automation Platforms | Limited | API available | Zapier, Make, n8n, Clay (native) |

Marketplace Integrations | Extensive (Slack, Microsoft, G2) | Focused on core tools | API-first for custom builds |

Setup Complexity | Complex, requires ops resources | Simple, quick activation | Minutes to first enrichment |

Workflow Orchestration | Deep, enterprise-grade | Basic data flow | API enables custom workflows |

ZoomInfo: The Enterprise Integration Powerhouse

ZoomInfo delivers deep, native integrations with enterprise heavyweights: Salesforce, HubSpot, Marketo, Outreach, Slack, Gong, Microsoft, and G2.

These aren't basic data syncs—you get automated lead routing, dynamic territory management, and real-time enrichment flowing seamlessly into your CRM.

The strength here is depth over breadth. If you're running sophisticated revenue operations with multiple tools that need to orchestrate together, ZoomInfo's integration architecture handles it.

But remember—this complexity mirrors the platform's overall learning curve. Setting up these workflows requires technical expertise and time.

Best for: Enterprise stacks where GTM data needs to orchestrate across complex tool chains.

Lead411: Simple Integrations That Just Work

Lead411 focuses on core integrations: Salesforce, HubSpot, Outreach, plus a Chrome extension and API for custom workflows.

No fancy orchestration layers, no complex routing rules—just straightforward data flow into tools your SDRs use daily.

This minimalist approach works for smaller teams. Integrations are quick to set up (matching that 9.2 ease score) and don't require a RevOps specialist to maintain.

The Chrome extension lets reps pull verified data directly from LinkedIn without switching tabs.

Best for: Teams that live in their CRM and need data flowing in without overhead.

FullEnrich: Built for Modern Automation Stacks

What we built: Native integrations with Zapier, Make, n8n, and Clay—the automation platforms modern teams actually use.

Our HubSpot 2-way sync means enriched data flows automatically both directions. Early access to Salesforce, Pipedrive, Outreach, and Salesloft integrations is rolling out now.

The API-first design means you can integrate in minutes, not weeks. Instead of forcing you into one vendor's ecosystem, we act as an enrichment layer that feeds clean data wherever you need it. The waterfall across 20+ sources ensures you're not limited by single-provider blind spots.

Best for: Teams using automation platforms like Clay or Make who need flexible, multi-source enrichment.

Test our integrations: Connect your first 50 enrichments free through our API, Zapier, or HubSpot sync.

Verdict on Integrations

🥇 Winner for Integrations: ZoomInfo (Extensive native integrations with enterprise GTM orchestration beat competitors' focused approaches)

🥈 Second Place: FullEnrich (Native automation platform integrations plus API-first design enable modern workflows)

🥉 Third Place: Lead411 (Core CRM integrations work well but limited automation platform support)

6. Compliance & Security

If you're selling to enterprises or handling international data, compliance isn't optional—it's table stakes. Here's where the gaps become dealbreakers.

Compliance Factor | ZoomInfo | Lead411 | FullEnrich |

|---|---|---|---|

GDPR Compliant | ✅ Yes | ❌ Not documented | ✅ Yes |

CCPA Compliant | ✅ Yes | ❌ Not documented | ✅ Yes |

SOC 2 Type II | Not specified | Not specified | ✅ Yes |

ISO 27701 | ✅ Yes | ❌ Not documented | Not specified |

Data Residency | Global infrastructure | Not specified | Compliant infrastructure |

Support Quality | Multi-channel, tier-based | "Great" per users | Dedicated team, responsive |

ZoomInfo: Enterprise-Grade Compliance

ZoomInfo checks all the enterprise boxes: CCPA, GDPR, and ISO 27701 certifications. If you're selling into regulated industries or handling European data subjects, these attestations aren't nice-to-haves—they're mandatory.

ZoomInfo's compliance posture reflects its enterprise focus, giving procurement teams what they need to push deals through legal review.

Support operates through multiple channels with their data services team receiving consistent praise.

The catch? Tier-based response times that often prioritize bigger accounts. If you're spending six figures annually, you'll get attention. Smaller accounts might wait.

Best for: Enterprise deals requiring documented compliance frameworks.

Lead411: The Compliance Blind Spot

Lead411's compliance story is notably absent from their public documentation. No GDPR certification mentioned. No CCPA framework outlined.

No ISO standards listed. Users consistently praise their "great customer service" and round-the-clock support, but for a platform handling contact data at scale, this silence is concerning.

If you're a startup selling to US SMBs, you might slide by. But if you have a single European customer or California-based enterprise deal, this gap becomes a dealbreaker.

You can't afford to ignore regulatory requirements just because your data vendor does.

Best for: US-only operations with no enterprise compliance requirements.

FullEnrich: Built Compliant from Day One

What we prioritized: SOC 2 Type II certification alongside GDPR and CCPA alignment—proving that even newer players can prioritize security without enterprise pricing.

Our infrastructure handles data residency requirements, and our dedicated support team (consistently praised for responsiveness) includes compliance guidance.

We maintain comprehensive documentation and transparent data handling practices. When you're enriching at scale across geographies, compliance can't be an afterthought.

Verdict on Compliance

🥇 Winner for Compliance: ZoomInfo (GDPR, CCPA, and ISO 27701 certifications deliver comprehensive enterprise-grade compliance)

🥈 Second Place: FullEnrich (SOC 2 Type II, GDPR, and CCPA alignment covers most requirements at mid-market pricing)

🥉 Third Place: Lead411 (Missing compliance documentation is a red flag for enterprise deals and international operations)

7. Our Honest Take

The ZoomInfo vs Lead411 decision isn't about which tool is "better"—it's about which tool matches your actual needs, budget, and team capacity.

ZoomInfo:

excels as a comprehensive GTM intelligence platform for enterprises that'll leverage AI workflows, org charts, and deep integrations.

If you have ops resources and six-figure budgets, the power is real.

Just prepare for opaque pricing, complex UI, and a steep learning curve.

Lead411:

wins on simplicity, transparency, and value for budget-conscious teams focused on US outbound.

Triple-verified contacts and Bombora intent for $490/year is genuinely compelling.

The limitation? Single-source coverage and limited advanced features.

Both trap you in single-vendor data limitations. When their database has gaps, you miss opportunities.

That's why we built FullEnrich with a different philosophy:

waterfall enrichment across 20+ premium sources with pay-on-success pricing.

You only pay for valid contacts found, credits roll over for three months, and mobile numbers come with landlines free.

It's enrichment accuracy at scale without the enterprise tax.

The honest trade-off? We're pure enrichment—no prospecting workflows, no intent signals, no org charts. But for teams prioritizing find rates and data accuracy across geographies, that focus delivers better results.

Ready to compare? Enrich your first 50 contacts free and see how multi-source waterfall enrichment stacks up against single-vendor coverage.

FAQ

Which is cheaper in 2025—ZoomInfo or Lead411?

Lead411 is significantly more affordable at $49/month for Spark or $490/year for annual Spark with Bombora intent included. ZoomInfo uses quote-based pricing with reports commonly starting around $25,000 annually for small teams, plus hidden costs and credit limitations. ZoomInfo Lite is free but limits downloads to around 10 contacts monthly—barely enough to test. FullEnrich starts at $29/month with pay-on-success credits that only charge for successful finds.

Who has better data accuracy?

It depends on your definition of accuracy. ZoomInfo delivers clean, compliant data with high enrichment accuracy but users report outdated records. Lead411 claims triple-verified emails (re-verified every 3-6 months) and 96% deliverability under specified conditions—strong for US contacts. FullEnrich hits ~80% find rates with <1% bounce through multi-source waterfall enrichment, often filling gaps both single-source providers miss. Test our accuracy yourself with 50 free enrichments.

Does either platform include intent data?

Yes, both offer intent but differently. ZoomInfo provides intent as part of its GTM AI platform with various pricing tiers (expect to pay premium). Lead411 includes Bombora buyer intent data on annual Spark ($490/year) and Pro plans—making it accessible for budget teams. FullEnrich doesn't offer intent signals; we focus purely on enrichment accuracy.

What are the biggest contract gotchas to watch for?

ZoomInfo's main traps: opaque pricing, hidden verification fees, credit caps (both daily and annual), and difficult cancellation terms users frequently complain about. Lead411 is more transparent but lower-tier export limits (1,000 monthly on Spark) can bottleneck growth. Always ask about: daily/weekly caps beyond total credits, verification fee structures, auto-renewal clauses, price escalation caps, and data access post-cancellation. FullEnrich avoids these gotchas with transparent pay-on-success pricing and 3-month credit rollover.

Which integrates better with my existing sales stack?

ZoomInfo wins on integration breadth with extensive native connections including Salesforce, HubSpot, Marketo, Outreach, Slack, Gong, Microsoft, and G2—perfect for complex enterprise stacks. Lead411 covers core integrations (Salesforce, HubSpot, Outreach) plus Chrome extension and API. FullEnrich offers native integrations with modern automation platforms (Zapier, Make, n8n, Clay) plus HubSpot 2-way sync and early access to Salesforce, Pipedrive, Outreach, and Salesloft—ideal for API-first workflows.

Which is better for small teams or startups?

Lead411 wins for small teams with $49/month starting price, 7-day trial with 50 exports, and 9.2 ease-of-setup score on G2. You'll be productive in under an hour. ZoomInfo's complex UI, steep learning curve, and enterprise pricing make it impractical for most startups. FullEnrich offers another path at $29/month with pay-on-success pricing and 50 free enrichments to test—start your trial now.

Can I get unlimited exports with either platform?

Lead411 offers unlimited search and exports on select annual plans (Blaze annual tier) plus rollover exports to prevent waste. ZoomInfo operates on credit-based systems with reported caps that can throttle campaigns during scaling. FullEnrich doesn't offer "unlimited exports" but credits only consume on successful finds with 3-month rollover—meaning you're not racing monthly caps or paying for failed searches.

Do these tools work for international prospecting?

ZoomInfo offers global coverage with varying quality by region. Lead411 is US-focused; international coverage takes a significant hit. FullEnrich waterfalls across 20+ vendors including international sources, delivering strong coverage across geographies—especially valuable for European, APAC, and LATAM prospects where single-source databases struggle. Test international enrichment free with your target regions.

Other Articles

Cost Per Opportunity (CPO): A Comprehensive Guide for Businesses

Discover how Cost Per Opportunity (CPO) acts as a key performance indicator in business strategy, offering insights into marketing and sales effectiveness.

Cost Per Sale Uncovered: Efficiency, Calculation, and Optimization in Digital Advertising

Explore Cost Per Sale (CPS) in digital advertising, its calculation and optimization for efficient ad strategies and increased profitability.

Customer Segmentation: Essential Guide for Effective Business Strategies

Discover how Customer Segmentation can drive your business strategy. Learn key concepts, benefits, and practical application tips.