Published on

Updated on

Choosing the right B2B contact data provider comes down to geography, budget, and whether you can afford gaps in your data enrichment.

With sales teams wasting over 27% of their time chasing bad data, the stakes for making the right choice have never been higher.

If you're evaluating Lusha and UpLead, you're comparing two popular mid-market solutions that promise accurate data without enterprise-level complexity.

But here's what most comparisons miss: both tools rely on single databases that inherently limit coverage and data accuracy.

Meanwhile, a new approach, waterfall enrichment, is changing how smart sales teams get verified contact data.

This comprehensive comparison breaks down everything you need to know about Lusha vs UpLead, from data accuracy and pricing to features and integrations.

Plus, we'll introduce you to a third option that might just solve the problems both tools leave on the table.

TLDR: For busy GTM leaders

Choose Lusha if: You're an individual contributor or small team primarily prospecting on LinkedIn, need a simple solution with minimal setup, and work mainly with european contacts for sales prospecting.

Choose UpLead if: Your team values verified email accuracy over volume, you need technographic data and intent signals, and you prefer transparent month-to-month pricing without long-term commitments.

Choose FullEnrich if: You need maximum match rates and coverage, want to pay only for successful results, require mobile-first direct dials, or need strong European data with GDPR compliance.

Quick Verdict: Lusha vs UpLead vs FullEnrich at a Glance

Lusha | UpLead | FullEnrich | |

|---|---|---|---|

Best For | LinkedIn workflows + intent data | Email-first North American prospecting | Maximum coverage across markets |

Starting Price | $49.90/month | $99/month | $29/month |

Free Trial | 70 credits/month | 7-day trial, 5 credits | 50 credits, full access |

Database | 285M profiles | 160M contacts | 20+ sources aggregated |

Credit Model | 1=email, 5-10=phone | 1=email+phone | 1=email, 10=phone |

Accuracy | 95% email, 90% phone | 95%+ with refunds | 85%, Triple-verified, invalid=free |

Rollover | Up to 2× monthly limit | No (monthly), Yes (annual) | 3 months (monthly), 12 (annual) |

Users | 1-5 per tier | 1 per plan | Unlimited all plans |

1. Data Quality and Verification: How Each Platform Ensures Accuracy

Data quality isn't just about accuracy percentages, it's about the real impact on your sales pipeline. Companies can lose up to 15% of revenue due to inaccurate contact data, primarily through wasted marketing spend and inefficient sales efforts.

Lusha | UpLead | FullEnrich | |

|---|---|---|---|

Size | 285M profiles | 160M contacts | 15+ sources |

Strong Regions | Europe, US, Israel | North America | Dynamic by location |

Email Verification | Real-time + crowdsourced | Real-time at unlock | Triple verification |

Refund Policy | None for stale data | Email bounces only | No charge for invalid |

Phone Quality | Mobile-focused, variable | Direct dials included | Waterfall increases finds |

Lusha's Data Verification Approach

Lusha takes a compliance-first approach to data verification, particularly excelling in European markets where GDPR requirements are strictest. The platform verifies data through community validation and periodic updates.

Claims 75-80% accuracy based on user reports

Strong European Union coverage with GDPR alignment

Community-sourced verification model

Updates database every 30-90 days

UpLead's Real-Time Verification

UpLead distinguishes itself with a bold 95% accuracy guarantee and real-time verification at the point of download. This means you're never charged for invalid emails—a significant advantage over credit-based competitors.

95% accuracy guarantee with instant refunds for bad data

Real-time verification prevents stale data issues

Particularly strong North American coverage

No charge for emails that fail verification

FullEnrich's Triple-Verification Waterfall System

FullEnrich takes verification to the next level with a comprehensive waterfall approach that sets a new standard for data quality:

Triple email verification: Uses 3 different verifiers to achieve bounce rates under 1%—significantly better than the industry average

Pay-per-success model: Invalid emails don't consume credits; the system continues searching until finding a valid result

Phone verification AI: Telecom ownership data combined with AI name-matching flags the best direct dials first

Smart landline handling: Global landline/VOIP detection means landlines are returned but don't consume credits while the system searches for mobile numbers

FullEnrich's enrichment results interface showing verified emails and phone numbers

👉 Ready to skip ahead? Get 50 free credits and test FullEnrich's waterfall enrichment against your current provider.

Coverage and Match Rates: Single Database vs Waterfall Enrichment

The fundamental difference between traditional providers and waterfall enrichment determines how much of your total addressable market you can actually reach.

Database Coverage Limitations

Both Lusha and UpLead operate on single-database models, which creates inherent limitations:

Lusha's Coverage: With 100M+ contacts, Lusha excels in European markets but shows gaps in North American mobile numbers and Asian markets. Their LinkedIn-first approach means better coverage for professionals active on the platform but misses those who aren't.

UpLead's Coverage: Boasting 160M+ contacts, UpLead provides stronger North American coverage but struggles with European mobile numbers and emerging markets. Their focus on company data means good firmographic information but sometimes incomplete personal contact details.

The Waterfall Advantage

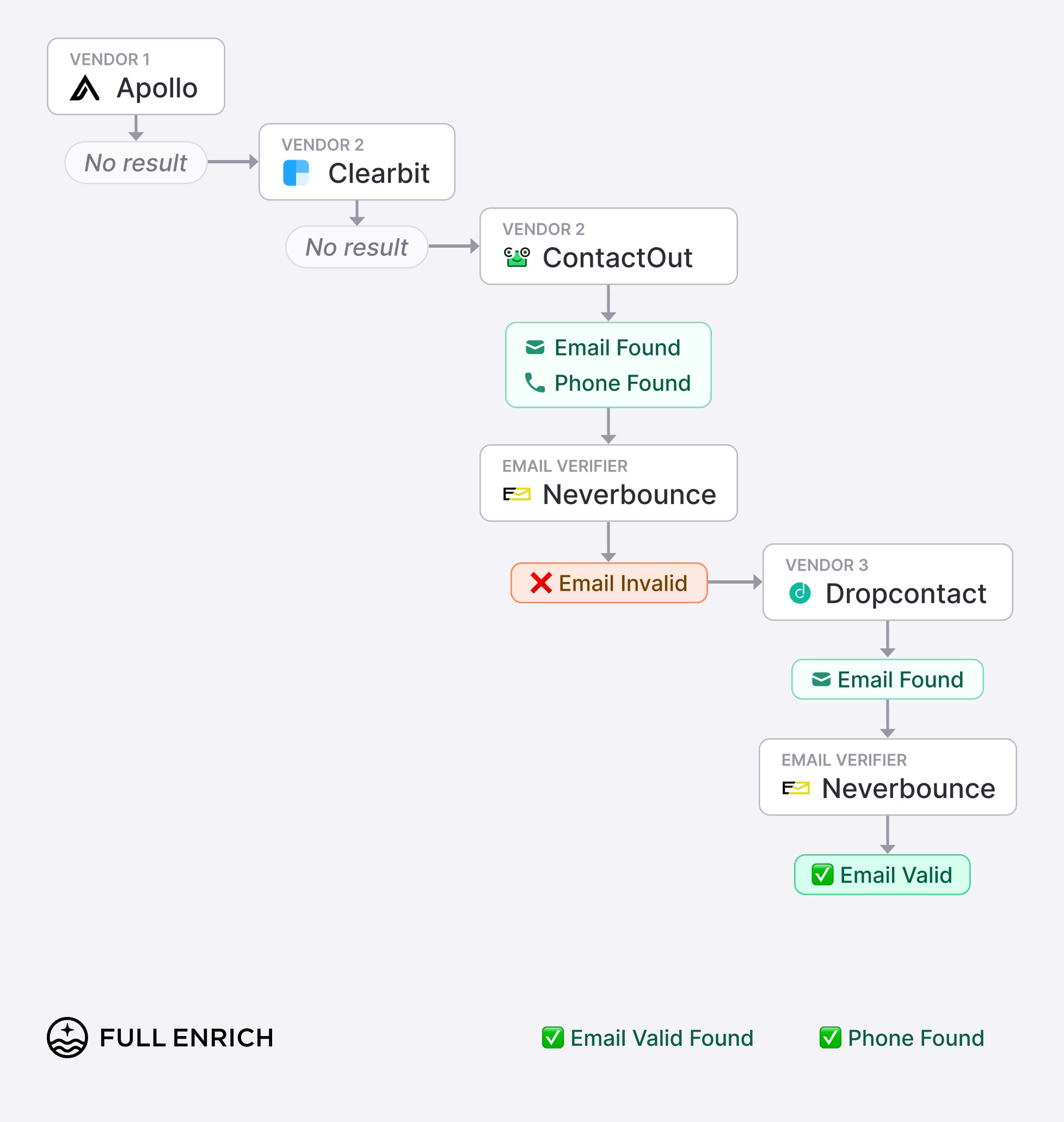

FullEnrich revolutionizes coverage through its waterfall enrichment methodology:

Multiple provider querying: Routes each lead through 15+ premium providers including Hunter, RocketReach, and Apollo

Dynamic regional optimization: Automatically selects the best providers based on your lead's geography

Never settle for "not found": Continues searching across providers until finding valid contact data

Scale without limits: Handles 50,000+ upload capacity without performance degradation

This approach embodies the philosophy: "Don't choose a B2B data vendor. Choose them all." The result? Significantly higher match rates than any single-database provider can achieve.

Ready to skip ahead? Get 50 free credits and test FullEnrich's waterfall enrichment against your current provider.

Lusha vs Uplead : Who has the best data ?

UpLead: Email-first North American campaigns needing accuracy guarantees

Lusha: European mobile numbers + buyer intent signals

FullEnrich: Maximum coverage when single-source gaps hurt pipeline

2. Pricing & Plans

Pricing transparency, credit costs, and contract flexibility determine total spend for sales teams scaling lead generation efforts.

Lusha | UpLead | FullEnrich | |

|---|---|---|---|

Entry | $49.90/month | $99/month | $29/month |

Credit System | 1=email, 5-10=phone | 1=email+phone | 1=email, 10=phone |

Rollover | Yes (2× cap) | No (monthly) | Yes (3-12 months) |

Users | Per-seat cost | Per-seat cost | Unlimited free |

Annual Discount | ~25% | ~25% | ~20% |

Lusha Tiers

Free Plan: 70 credits/month

Professional: $49.90/month (~$37 annual), 500 credits, 3 users max

Premium: $79.90/month (~$60 annual), 1,000 credits, 5 users max

Scale: $15K+/year (annual only), "unlimited" with 2,000/month fair-use cap

👉 To learn more about Lusha pricing

Hidden costs: Phone numbers cost 5-10× emails. Buyer intent, job alerts, API, SSO locked to Scale tier. Auto-renewal with 10-20% price increases. Downgrade = forfeit remaining credits.

Reddit: "Lusha does NOT offer unlimited credits. They limit you to 2000 credits per month due to 'fair use'."

UpLead Tiers

Essentials: $99/month ($74 annual), 170 credits

Plus: $199/month ($149 annual), 400 credits

Professional: ~$399/month (annual only), 1,000 credits, 5 users

Enterprise: Custom pricing

Free plan: 5 Credit

👉 To learn more about Uplead pricing

Friction points: Monthly credits expire. Cancellation requires Zoom call with rep. Annual needs 60-day notice. No refunds for unused credits or early downgrades.

FullEnrich Pricing

Starter: $29/month, 500 credits

Pro: $55/month, 1,000 credits

Scale: Custom from $500/month

Free plan: 50 credit

👉 To learn more about FullEnrich pricing

Includes: Unlimited users, 3-12 month rollover, full API access, no charge for invalid emails, waterfall across 15+ sources.

Lusha vs uplead : Who Has the best pricing ?

Under $100 budget: FullEnrich Starter ($29) delivers most coverage

Need intent signals: Lusha Premium ($80), accept phone credit costs

Want refund guarantees: UpLead Essentials ($99), accept expiring credits

Scaling teams: FullEnrich's unlimited users eliminate per-seat costs

3. Key Features

Advanced features, browser extension quality, and integration capabilities determine whether prospecting tools streamline or complicate sales productivity.

Lusha | UpLead | FullEnrich | |

|---|---|---|---|

Search Filters | 50+ criteria | 50+ criteria | Enrichment-only |

Buyer Intent | ✅ Premium/Scale | ❌ No | ❌ No |

Job Alerts | ✅ Premium/Scale | ❌ No | ❌ No |

Chrome Extension | ✅ LinkedIn + web | ✅ LinkedIn + web | ✅ Sales Navigator export |

CSV Enrichment | ✅ 500-10K rows | ✅ Unlimited | ✅ Unlimited |

Waterfall | ❌ Single source | ❌ Single source | ✅ 15+ sources |

API | Premium/Scale only | Professional+ only | ✅ All plans |

Intent Data & Job Alerts

Lusha Premium/Scale includes buyer intent signals and job change notifications. Helps prioritize accounts showing purchase signals and re-engage contacts at new companies.

UpLead and FullEnrich don't offer intent data. Pair with 6sense or Bombora if needed.

Search vs Enrichment

Lusha and UpLead are search databases—build lists using 50+ filters for company data (title, industry, size, technographics).

UpLead interface: Simpler, faster learning curve. Reddit: "easier to navigate"

Lusha interface: More features, steeper learning curve

FullEnrich isn't a search tool. Upload your prospect list (from LinkedIn, Clay, Apollo), it enriches with accurate data coverage from 15+ sources.

Chrome Extensions

All three offer LinkedIn prospecting extensions.

Lusha: Shows emails/phones on LinkedIn profiles, one-click export to CRM

UpLead: Similar functionality, "less robust" UI per user reviews

FullEnrich: Exports up to 2,500 LinkedIn Sales Navigator leads at once with one-click enrichment

Lusha vs Uplead: Who has the best features ?

Need intent signals: Lusha Premium required

Want simple search + enrichment: UpLead's clean interface

Already have prospect lists: FullEnrich enriches better than either but lack advanced features

4. CRM Integration & Automation

Integration capabilities and workflow automation determine whether data enrichment happens seamlessly or requires manual CSV exports slowing sales productivity.

Lusha | UpLead | FullEnrich | |

|---|---|---|---|

Native CRM | Salesforce, HubSpot, Dynamics, Pipedrive, Zoho, Bullhorn | Salesforce, HubSpot, Dynamics, Pipedrive, Zoho, Copper | Salesforce, HubSpot, Pipedrive |

Sales Engagement | Outreach, Salesloft | Outreach, Salesloft, Reply.io, Lemlist, Mailshake | Via Zapier/Make |

API Tier | Premium/Scale only | Professional+ only | All plans |

No-Code | Zapier, Workato | Zapier | Zapier, Make, Clay, n8n |

Email Add-ins | Gmail, Outlook | Gmail, Outlook | N/A |

Sales Engagement and Automation Tools

Lusha: Offers basic integrations with major sales engagement platforms but requires manual data export/import for most workflows. The Chrome extension simplifies LinkedIn prospecting but doesn't extend to automated sequences.

UpLead: Provides native integrations with Outreach, SalesLoft, Reply.io, and other major platforms. The Chrome extension works across LinkedIn and company websites, enabling seamless prospecting workflows.

FullEnrich: Takes a different approach with:

Native automation: Zapier, Make, and n8n actions for workflow building

Clay integration: Available as a data provider within Clay's platform

Unified API: Simple REST API for real-time and bulk enrichment

LinkedIn enhancement: Chrome extension for Sales Navigator list exports and enrichment

Check out FullEnrich's integration options to see how waterfall enrichment fits into your tech stack.

Lusha vs uplead: Who has the best integration ecosystem ?

Simple CRM tools push: Any platform works

Need API for workflows: FullEnrich (all plans) or upgrade to Lusha/UpLead enterprise tiers

Modern RevOps stack: FullEnrich's Make/Clay integrations fit better

5. Compliance & Privacy

GDPR compliance, data sourcing transparency, and regulatory history matter for sales teams prospecting internationally and companies in regulated industries.

Lusha | UpLead | FullEnrich | |

|---|---|---|---|

GDPR Compliant | Yes (under investigation) | Yes | Yes |

Certifications | ISO 27001/27701, SOC 2 | None disclosed | Standard compliance |

DPA Available | Yes (on request) | Yes (on request) | Yes |

Legal Issues | Italy investigation 2025 | California fine $34K (2024) | None reported |

Data Sourcing | Crowdsourced + automated | Public + partnerships | Aggregates verified sources |

Lusha Compliance

ISO 27001/27701, SOC 2 Type II certified. Uses "legitimate interest" basis under GDPR with opt-out mechanisms.

Issue: Italy's Data Protection Authority launched investigation (April 2025) over potential GDPR violations—complaints about cold calls traced to Lusha data without proper consent.

France's CNIL previously investigated browser extension practices (2022), closed without fines due to jurisdictional nuances.

Reddit sentiment: "They claim to be GDPR-conform, which I highly doubt"

UpLead Compliance

States GDPR/CCPA compliance, Standard Contractual Clauses for EU transfers, online opt-out form available.

Issue: California Privacy Protection Agency fined UpLead $34,400 (2024) for failing to register as data broker by required date. Procedural violation, not data breach—but shows compliance gaps.

No published DPA on website (must request). Privacy policy puts onus on customers to use data lawfully in their regions.

FullEnrich Compliance

GDPR/CCPA compliant, DPA available. No reported breaches or regulatory actions.

Aggregates from verified sources rather than maintaining proprietary database—different risk profile than competitors.

Lusha vs Uplead : Who is the most compliant ?

Strict compliance requirements: All three have some gaps; review DPAs carefully

EU-focused: Lusha faces ongoing scrutiny, proceed cautiously

Clean record: FullEnrich has no reported violations

6. User Experience & Support

Lusha | UpLead | FullEnrich | |

|---|---|---|---|

Learning Curve | Moderate (feature-rich) | Low (simple interface) | Low (enrichment-focused) |

Support | Tiered (better at Scale) | Email/chat (response varies) | Chat support all plans |

Training | Self-serve docs | Self-serve docs | Self-serve docs + responsive team |

Cancellation | Account settings | Requires Zoom call | Account settings |

Lusha Experience

Feature-rich interface with steeper learning curve. G2: "Customer support is poor, as it only features a product demo for very high paying customers, not for the Premium plan users."

Support quality correlates with plan tier—enterprise gets attention, SMBs get help center.

UpLead Experience

Clean, simple interface praised for ease of use. Reddit: "pleasantly surprised by how clean the UI is"

Friction: Canceling requires scheduling Zoom call with rep—unusual hurdle. G2: "if I cancel they cut me off without allowing me to finish out my subscription"

Support responsiveness mixed—some praise it, others report slow responses.

FullEnrich Experience

Minimal learning curve—upload CSV, get enriched data back. LinkedIn extension exports with one click.

Users praise responsive support and user friendly interface. Team actively engages with customer feedback.

Lusha vs uplead: Who has the best experience ?

Fastest to value: UpLead's simple interface

Need hand-holding: All three rely on self-serve docs

Easiest to cancel: Lusha and FullEnrich via account settings

Lusha vs UpLead: Who fits your GTM best ?

Use Case | Best Choice | Why |

|---|---|---|

SMB, <$100/month budget | FullEnrich Starter | $29/month, 500 credits, unlimited users, waterfall coverage |

Email-first North America prospecting | UpLead Essentials | 95%+ accuracy with refunds, $99/month |

European mobile numbers needed | Lusha Premium | 87% EU accuracy, strong mobile coverage, $80/month |

Need buyer intent signals | Lusha Premium/Scale | Only option with intent data + job alerts |

Scaling 10+ person team | FullEnrich Pro | $55/month unlimited users vs $800-2K/month competitors |

API-first enrichment workflows | FullEnrich | API on all plans, Lusha/UpLead require enterprise tiers |

International prospecting | FullEnrich | Waterfall across 15+ sources, dynamic provider selection |

Low match rates from current tool | FullEnrich | 80-85% match rate vs 50-60% single-source |

Compliance-sensitive (GDPR strict) | FullEnrich | Cleaner record than Lusha (though had CA issue) |

LinkedIn-heavy workflows | Lusha or UpLead | Both have solid Chrome extensions |

Agency managing multiple clients | FullEnrich Scale | Unlimited users, credits roll over, white-label options |

Need credit-back guarantees | UpLead | Only platform refunding email bounces |

The Verdict: Choosing Between Lusha, UpLead, and Waterfall Enrichment

Lusha and UpLead solve different problems at different price points, but both share the same architectural limitation.

Lusha delivers buyer intent data, job change alerts, and strong European mobile data coverage starting at $49/month. Best for sophisticated sales teams needing intelligence signals beyond contact data. The dual credit model (1 for emails, 5-10 for phones) creates budget surprises, and premium features require expensive Scale contracts.

UpLead excels at verified email prospecting with 95%+ accuracy guarantees and automatic refunds for bounces at $99/month. Best for North American email campaigns where accuracy matters more than database size. Monthly credit expiration and smaller database (160M vs 285M) limit flexibility.

The problem both platforms share: Single-source databases with 50-60% match rates. When their provider doesn't have your prospect's contact info, you've wasted credits. Neither can find what they don't have.

Why Teams Are Adopting Waterfall Enrichment

This is where FullEnrich changes the equation.

Instead of subscribing to one database hoping it has your prospects, waterfall enrichment queries 15+ premium sources sequentially—Apollo, Clearbit, Hunter, Snov.io, Datagma, ContactOut, and more—until contact information is found.

What you get:

✓ 80-85% match rates versus 50-60% single-source—find 30-50% more valid contacts from same prospect list

✓ No credit waste on "not found" results—only pay when data is successfully enriched

✓ Triple email verification across sources ensures accuracy; invalid emails don't consume credits

✓ Geographic optimization automatically selects best provider based on prospect location

✓ Unlimited users at no extra cost—no per-seat fees as team scales

✓ Credits roll over 3 months (monthly) or 12 months (annual)—no use-it-or-lose-it pressure

Every "not found" result from single-source tools represents a prospect you can't contact. Those gaps compound—hundreds of unreachable prospects shrinking pipeline.

Waterfall enrichment eliminates this by accessing every major B2B data source simultaneously.

Start with 50 free credits. No credit card required.

Looking beyond Lusha and UpLead? There are some Lusha alternatives or UpLead alternatives like FullEnrich worth exploring.

FAQ

What's better than Lusha?

For European prospecting with buyer intent needs, Cognism competes directly with stronger EU GDPR compliance. For maximum contact coverage across all geographies, waterfall enrichment platforms like FullEnrich deliver 80-85% match rates versus Lusha's 50-60% by querying 15+ sources sequentially. FullEnrich costs $29-55/month with unlimited users versus Lusha's $800/month for 10-person teams. Apollo.io offers similar pricing to Lusha but adds built-in email sequences. The "better" choice depends whether you need intent data (Lusha wins), maximum coverage (waterfall wins), or all-in-one platform (Apollo wins).

Is UpLead worth the money?

For small teams (<5 people) running email-first North American campaigns, UpLead's 95%+ accuracy guarantee and credit-back policy justify $99/month. The real-time verification prevents deliverability damage from bounced emails. However, match rates around 50-60% mean half your prospect list returns "not found" results. Monthly credit expiration adds pressure—unused credits vanish at month-end. Teams scaling beyond 5 users hit expensive per-seat costs ($199+ per additional user). Waterfall enrichment delivers 30-50% more valid contacts at lower cost, making UpLead's value questionable at scale.

Why is Lusha so expensive?

Lusha's pricing appears lower ($49/month entry) but phone numbers cost 5-10 credits each while emails cost 1 credit. A team targeting mobile numbers burns through 500 monthly credits after just 50-100 phone reveals. Premium features (buyer intent, job alerts, API, SSO) require Premium ($80/month) or Scale ($15K+/year) plans. Per-seat costs multiply fast—10 users on Premium = $800/month. The crowdsourced data model, ISO certifications, and intent signal infrastructure drive costs higher than pure contact enrichment competitors. Teams paying for Lusha essentially fund its compliance overhead and enterprise features even on lower tiers.

Is UpLead data accurate?

UpLead guarantees 95%+ email accuracy with real-time verification at unlock moment and automatic credit refunds for bounces. Independent G2 reviews rate UpLead's contact data accuracy 8.5/10, slightly above competitors. Users consistently report "close to 100% accuracy" and "95% deliverability" across outreach campaigns. However, the credit-back guarantee applies only to emails, not phone numbers—bounced direct dials don't get refunded. Geographic accuracy varies: strongest in North America, moderate in Europe, lighter in APAC. A Capterra reviewer noted "slightly higher bounce rates than the 5% advertised" for international phone numbers.

Other Articles

Cost Per Opportunity (CPO): A Comprehensive Guide for Businesses

Discover how Cost Per Opportunity (CPO) acts as a key performance indicator in business strategy, offering insights into marketing and sales effectiveness.

Cost Per Sale Uncovered: Efficiency, Calculation, and Optimization in Digital Advertising

Explore Cost Per Sale (CPS) in digital advertising, its calculation and optimization for efficient ad strategies and increased profitability.

Customer Segmentation: Essential Guide for Effective Business Strategies

Discover how Customer Segmentation can drive your business strategy. Learn key concepts, benefits, and practical application tips.