Published on

Updated on

You're building an outbound motion into your sales processes. You need contact data. And now you're stuck comparing two tools that both claim to have "the best" B2B data.

Welcome to every sales leader's nightmare.

You searched "Cognism vs UpLead" and here you are.

I've used both platforms for prospecting campaigns across North America and EMEA. In this comparison, I'll break down what each tool actually does well, where they fall short, and who should use which platform.

Spoiler: they both have the same fundamental weakness. But we'll get to that.

Who is each tool best for?

I went deep in this article. By the end, you'll know exactly which platform fits your GTM strategy.

But if you want the TLDR, here it is:

Cognism is for enterprise sales teams prospecting in Europe with annual budgets above $15K. The platform delivers phone-verified Diamond Data with 87% connect rates and sales intelligence features like intent data and org charts. Expect to pay $15K-$35K/year with annual-only contracts.

UpLead is for SMB to mid-market teams needing verified emails without breaking the bank. You get real-time email verification with a 95% accuracy guarantee and credit-back for bounces, starting at $99/month with monthly flexibility. Perfect for email-focused campaigns on a budget.

FullEnrich solves what both platforms struggle with—single-source limitations. By querying 15+ data providers sequentially (waterfall enrichment), it delivers 80-85% match rates across all geographies at $29-$55/month. No vendor lock-in, credits only on verified matches.

My recommendation? If you're prospecting in EMEA with a big budget and need phone accuracy, go Cognism. If you need verified emails on a tight budget, go UpLead. If you want maximum coverage without vendor lock-in, go FullEnrich.

👉 Ready to skip ahead? Get 50 free credits and test FullEnrich's waterfall enrichment against your current provider.

Cognism vs UpLead side-by-side comparison:

Feature | Cognism | UpLead | FullEnrich |

|---|---|---|---|

Best For | Enterprise EMEA prospecting | SMB verified email prospecting | Maximum coverage, all regions |

Price | ~$15K-$35K/year | $99-$199/month | $29-$55/month |

Contracts | Annual only | Monthly or annual | Monthly or annual |

Database | 400M profiles | 160M contacts | 15+ aggregated sources |

Regional Strength | EMEA (180% more UK data) | Global (strongest NA) | Balanced via waterfall |

Phone Quality | 98% (human-verified) | Direct dials (not guaranteed) | 70-75% across providers |

Email Quality | High (AI-verified) | 95%+ (real-time verified) | Triple verification (real time data verification) |

Credits Rollover | No | Annual plans only | 3-12 months |

API Access | ✅ | ✅ (Pro+ tiers) | ✅ (all plans) |

1. Data quality: Who has better contact accuracy?

This is what actually matters. Bad data kills pipeline.

Metric | Cognism | UpLead | FullEnrich |

|---|---|---|---|

Total Contacts | 400M | 160M | 15+ aggregated |

Geographic Strength | EMEA leader | Global | Multi-source |

Phone Accuracy | 98% (Diamond Data®) | Not guaranteed | 70-75% |

Email Accuracy | High | 95%+ with refund | Triple verified |

Match Rate | ~90% | Not disclosed | 80-85% |

Cognism's data quality

Cognism dominates EMEA. 400 million profiles with 180% more UK contacts and 250%+ more in France/Germany than competitors.

The real differentiator is Diamond Data®, phone-verified mobile numbers with 87% connect rates. Compare that to the 30% industry average.

One G2 reviewer: "their quality of contact details is insane... they almost always have the email, and most of the time they also have the mobile phone."

But outside Western Europe? Accuracy drops. APAC coverage is weak. North America is decent for enterprise accounts but has gaps in mid-market.

Reddit user: "Cognism is fantastic in Europe, but could be stronger for the US."

UpLead's data quality

UpLead nails email accuracy. Every email verified in real-time at unlock. 95%+ accuracy with automatic credit refunds for bounces.

160 million contacts across 200+ countries. Direct dial phones included (not company main lines).

G2 reviewer: "It is the easiest lead tool and, by far, the most accurate... and for the price, you can't beat it."

The catch: Phone accuracy isn't guaranteed. Credit-back only applies to emails. Some users report bounce rates above the advertised 5% in niche segments.

The single-source problem

Both platforms rely on one database. When their source doesn't have the contact, you've wasted the credit.

This is especially brutal for international prospecting. A U.S.-based vendor might hit 70% in North America but only 10-20% in EMEA.

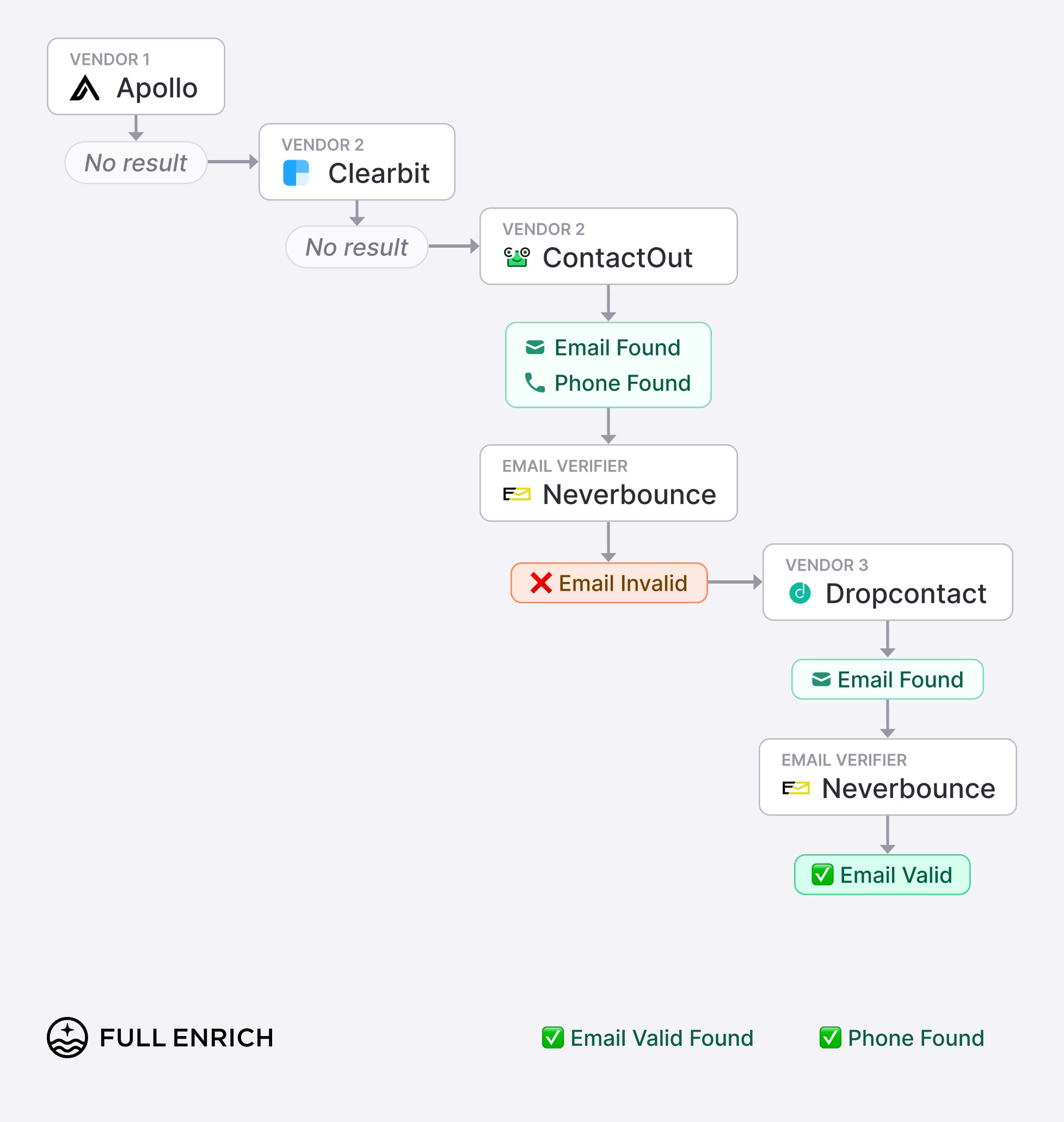

FullEnrich solves this with waterfall enrichment. Queries 20+ providers sequentially, Apollo, Clearbit, Snov, Hunter, and 11+ more.

If one provider misses, the next one catches it. Independent testing shows 80-85% match rates versus 60-70% for single-source.

The difference compounds at scale. On a 1,000-contact list, that's 150-250 more verified contacts.

👉 Ready to skip ahead? Get 50 free credits and test FullEnrich's waterfall enrichment against your current provider.

Verdict: Data quality winner

EMEA phone prospecting: Cognism's Diamond Data® delivers 87% connect rates (if you have $15K+ budget).

Verified email on budget: UpLead's 95%+ verification at $99-$199/month.

Maximum coverage globally: FullEnrich's waterfall at $29-$55/month finds contacts both platforms miss. If you want maximum data accuracy, you can't go wrong.

👉 Start using Full Enrich for Free with 50 credits No credit card required.

2. Pricing & Plans

Let's talk money. Because sticker shock is real with these tools.

Factor | Cognism | UpLead | FullEnrich |

|---|---|---|---|

Transparency | Hidden (sales calls) | Published | Published |

Entry Price | ~$15K-$35K/year | $99/month | $29/month |

Model | Seat-based | Credit-based | Pay-on-success |

Contracts | Annual only | Monthly or annual | Monthly or annual |

Rollover | No | Annual only | 3-12 months |

Cognism pricing

You can't see prices without a sales call. That alone should tell you something.

Reported pricing: Platinum ~$15K/year + $1,500/user. Diamond ~$25K + $2,500/user.

Small teams pay $5K-$12K. Mid-market deals hit $25K-$35K annually. Median around $35K/year.

Annual contracts only. No monthly option. Auto-renewal with 30-60 day cancellation notice.

Miss that window? You're locked for another year.

Negotiation expected: 15-30% discounts common at quarter-end.

👉 To learn more about cognism pricing & Plans

UpLead pricing

Transparent, published rates.

Essentials: $99/month (170 credits) or $74/month annual

Plus: $199/month (400 credits) or $149/month annual

Professional: Custom (annual only)

One credit = one contact (email + phone).

Monthly plans: Credits expire.

Annual plans: Use anytime within the year.

The annoying part: Cancelling requires a Zoom call. No simple cancel button.

One reviewer: "if I cancel they cut me off without allowing me to finish out my subscription."

👉 To learn more about Uplead pricing & Plans

FullEnrich pricing

Simple, transparent, usage-based.

Starter: $29/month (500 credits)

Pro: $55/month (1,000 credits)

1 email = 1 credit. 1 phone = 10 credits.

👉 To learn more about FullEnrich pricing & Plans

Key difference: Credits only charged on verified matches. No waste on "not found" results. Which is essential to keep your sales efforts.

Rollover: 3 months (monthly), 12 months (annual). Cancel anytime—no calls.

Verdict: Pricing winner

Enterprise with annual budgets: Cognism's seat-based model works (if you negotiate).

Month-to-month flexibility: UpLead at $99-$199 without long commitments.

Cost efficiency: FullEnrich at $29-$55, charging only on successful matches.

3. Key Features: What can you actually do?

Let's get practical. What does each platform enable?

Feature | Cognism | UpLead | FullEnrich |

|---|---|---|---|

Intent Data | ✅ (Bombora) | ❌ | ❌ |

Org Charts | ✅ | ❌ | ❌ |

Chrome Extension | ✅ | ✅ | ❌ (removed) |

Search Database | ✅ (50+ filters) | ✅ (50+ filters) | ❌ (enrichment only) |

Waterfall Enrichment | ❌ | ❌ | ✅ (20+ providers) |

API Access | ✅ | ✅ (Pro+) | ✅ (all plans) |

Bulk Enrichment | ✅ | ✅ | ✅ |

Intent data & buyer signals

Cognism provides Bombora-powered intent data showing which companies are researching topics related to your product.

Combined with sales triggers (funding events, job changes, tech stack changes), you can time outreach when buyers are actively looking.

UpLead lacks intent data. You get contact information but no indication of purchase readiness.

FullEnrich doesn't offer intent data—it's enrichment-only. You need external tools for buyer signals.

What this means: Cognism helps prioritize which accounts to target. UpLead and FullEnrich require external tools for timing.

Organizational charts

Cognism offers org chart visualization showing reporting structures and team hierarchies. Map decision-makers before reaching out.

UpLead doesn't provide org charts. You see individual contacts but not their relationships.

FullEnrich doesn't offer org charts—it enriches the contacts you already identified.

What this means: For enterprise selling requiring multi-threading, Cognism's org charts save research time. UpLead and FullEnrich work for transactional sales targeting specific roles.

Search & targeting

Both Cognism and UpLead offer 50+ search filters (industry, title, company size, technographics, location).

Cognism's interface is powerful but has a learning curve. Initial onboarding can feel overwhelming.

UpLead's interface is cleaner and faster to master. One Reddit user: "UpLead was a better fit for us... easier to navigate and still gives you access to verified emails."

FullEnrich doesn't offer native search—it's enrichment-only. You bring leads from LinkedIn, CRM, or other sources.

Chrome extensions

Cognism's Chrome extension pulls data while browsing LinkedIn or company websites. Push contacts directly into CRM or sequences.

UpLead's Chrome extension works similarly—prospect on LinkedIn without leaving the page. Some users note it's "less robust" than competitors in UI polish.

FullEnrich removed their Chrome extension. Platform is now CSV upload + API only.

Verdict: Features winner

Enterprise ABM with complex buying committees: Cognism's intent data and org charts justify the premium.

Fast email list-building: UpLead's clean interface and 50+ filters at $99-$199/month.

Enriching existing lists: FullEnrich's waterfall delivers maximum coverage on leads you already have.

4. CRM integration & workflow automation

Integration depth affects whether enrichment happens automatically or requires manual work for your sales team.

Integration Type | Cognism | UpLead | FullEnrich |

|---|---|---|---|

Native CRM | Salesforce, HubSpot, Dynamics 365, Pipedrive, Zoho | Salesforce, HubSpot, Zoho, Pipedrive, Dynamics 365, Copper | HubSpot (live), Salesforce/Pipedrive (coming) |

Sales Engagement | Outreach, Salesloft | Outreach, Salesloft, Reply.io, Lemlist, Mailshake, Woodpecker | Via Zapier/Make |

Data Warehouses | Via API only | Via API/CSV only | Via API only |

API Availability | ✅ (setup required) | ✅ (Professional+ tiers) | ✅ (all plans, well-documented) |

No-Code Tools | Zapier | Zapier (1,500+ apps) | Zapier, Make, n8n, Clay |

CRM and sales tool connectivity

Cognism offers native integrations with Salesforce, HubSpot, Dynamics 365, Pipedrive, and Zoho. Data syncs into CRM with field mapping, avoiding manual CSV imports.

One G2 review: "the ability to seamlessly upload new leads directly from Cognism into our CRM is a major win... eliminates manual data entry."

Chrome extension pushes contacts directly into CRM or sequences from LinkedIn.

UpLead provides one-click integrations for Salesforce, HubSpot, Zoho, Pipedrive, Dynamics 365, and Copper. Plus sales engagement tools like Outreach, Salesloft, Reply.io, Woodpecker, Lemlist, and Mailshake.

Export leads directly into CRM or sequence tools. Professional tier supports bi-directional sync.

FullEnrich's native integrations are limited. HubSpot works now (2-way sync with deduplication). Salesforce and Pipedrive marked "coming soon."

Most integrations happen via Zapier, Make, n8n or API.

API and developer experience

Cognism provides a REST API with comprehensive documentation at developers.cognism.com. Search contacts by filters, company lookups, bulk enrich endpoint.

Rate limiting applies. Some plans may limit API calls or require purchasing credits for high volumes.

UpLead's REST API offers endpoints for person/company search, email finder, bulk prospector queries. 500 requests/minute default limit.

API fully available to Professional/Enterprise customers. Plus plan includes limited API calls.

FullEnrich is API-first on all plans. Even $29/month Starter includes full API access. Enrich one-by-one or bulk, get results via webhook or polling.

Well-documented with straightforward authentication. No hidden API fees or tier restrictions.

No-code automation workflows

Cognism connects via Zapier for custom workflows. Can trigger enrichment when new leads enter HubSpot, for example.

UpLead works with Zapier offering connectivity to 1,500+ applications. Templates exist for routing contacts to Google Sheets, various CRMs, etc.

FullEnrich supports Zapier, Make, n8n, and Clay. Popular use case: when new contact enters HubSpot, trigger FullEnrich waterfall enrichment, fill missing email/phone, update HubSpot automatically.

Clay integration particularly powerful for sophisticated enrichment workflows combining multiple data sources.

Verdict: Integration winner

Native CRM depth: Tie between Cognism and UpLead—both offer solid native integrations with major platforms.

API access: FullEnrich wins (full access on all plans vs Professional-tier requirement).

No-code automation: FullEnrich wins (Zapier + Make + n8n + Clay support).

5. User experience & ease of use

User experience affects adoption and time wasted fighting the platform.

Factor | Cognism | UpLead | FullEnrich |

|---|---|---|---|

Learning Curve | Moderate (many features) | Low (30 minutes) | Low (enrichment-only) |

Interface | Powerful but overwhelming initially | Clean, intuitive | Simple web app + CSV + API |

Training Required | Yes (onboarding sessions) | Minimal (self-serve) | Minimal (documentation) |

Support Channels | Dedicated CSM (larger accounts), live chat | Email, chat support | Email, chat support |

Cancellation | 30-60 day notice via sales | Zoom call required | Cancel directly in app |

Time to First Value | 1-2 weeks (setup + training) | Same day | Same day |

Cognism's user experience

Interface is powerful but complex. Many filters and options create a learning curve. Initial onboarding can feel "a bit overwhelming".

Cognism provides dedicated Customer Success Manager for larger accounts. Live chat support with 20-second average response, 99% satisfaction.

One G2 review: "our CSM was very responsive and helpful... a huge plus."

Cancellation requires 30-60 day notice to avoid auto-renewal. Must contact sales—no self-serve button.

UpLead's user experience

Clean, intuitive interface. Most users productive within 30 minutes.

Reddit user: "UpLead was a better fit for us... easier to navigate and still gives you access to verified emails."

Chrome extension praised for convenience, though some note it's "less robust" than competitors in UI polish.

Support quality mixed. Some users had "incredible support from multiple team members that continually show concern for our success." Others report slow response times.

Cancellation frustration: Requires scheduling a Zoom call. No simple "cancel subscription" button catches users off guard.

FullEnrich's user experience

Straightforward enrichment workflow. Upload CSV, select enrichment type (email, phone, or both), get results. No complex setup. User friendly interface.

Chrome extension was removed (no longer available). Platform is enrichment-only—doesn't offer prospecting features or native search.

API-first design means developers integrate easily. Well-documented endpoints.

G2 reviewers: "The front end is very intuitive and easy to use (list import + enrichment in a few minutes)."

Support responsive via chat. Cancel directly in workspace settings—no calls required.

Verdict: Ease of use winner

Feature-rich with support: Cognism's dedicated CSMs justify premium for enterprise teams needing hand-holding.

Get-started-fast simplicity: UpLead's clean interface delivers productivity in 30 minutes, though cancellation friction annoys.

No-nonsense enrichment: FullEnrich's simple workflow (upload → enrich → done) and self-serve cancellation.

6. Compliance & privacy considerations

Compliance determines legal risk, especially for EMEA teams or regulated industries.

Compliance Factor | Cognism | UpLead | FullEnrich |

|---|---|---|---|

GDPR/CCPA | ✅ Fully compliant | ✅ States compliance | ✅ Fully compliant |

Certifications | ISO 27001, ISO 27701, SOC 2 Type II | None publicly disclosed | SOC 2 Type II |

DPA Availability | ✅ (standard, upon request) | ✅ (upon request) | ✅ (published online) |

Data Breach History | None reported | None reported | None reported |

Legal Scrutiny | Clean (sends Article 14 notices) | $34,400 CA fine (2024, procedural) | None reported |

Data Processing Location | UK/EU processing available | U.S.-based (SCCs for transfers) | U.S.-based (SCCs for transfers) |

DNC Scrubbing | ✅ (13 registries globally) | Not advertised | Via source providers |

Cognism's compliance stance

Cognism built GDPR into its foundation. Registered with UK ICO as data broker. ISO 27001/27701 certified. SOC 2 Type II attested.

Uses Legitimate Interest as lawful basis for B2B data. Conducts Legitimate Interest Assessments and Data Protection Impact Assessments with external counsel.

Sends Article 14 notice emails to everyone in database informing them Cognism holds their data with opt-out link. Dedicated team handles Data Subject Access Requests.

Screens phone numbers against 13 Do Not Call registries globally (TPS/CTPS in UK, FTC DNC in US, others in EU/Australia).

No data breaches reported. Clean compliance track record.

UpLead's compliance stance

UpLead states GDPR/CCPA compliance. Collects business-related contact data only. Asserts Legitimate Interest basis in EU. Implemented Standard Contractual Clauses for EU data transfers.

Offers online opt-out form for individuals.

DPA not publicly posted but provided upon request for customers needing GDPR Article 28 compliance.

Compliance incident in 2024: Fined $34,400 by California Privacy Protection Agency for failing to register as data broker by required date. Quickly settled and registered. Procedural issue, not data breach.

No data breaches reported. U.S.-based with SCCs for transfers.

FullEnrich's compliance approach

FullEnrich is GDPR and CCPA compliant with SOC 2 Type II certification. DPA published online at fullenrich.com/data-processing-agreement.

Standard Contractual Clauses included for EU data transfers. U.S.-based but implements encryption (bcrypt with 14 rounds) and technical safeguards.

Key difference: FullEnrich doesn't store contact databases. Acts as processor only—queries providers and returns matches. No ongoing data retention reduces compliance surface area.

Data lineage and auditability

Single-source providers (Cognism, UpLead) don't disclose specific data provenance. You know it came from "their database" but not original sources.

FullEnrich provides source-level visibility. Shows which of 15+ providers returned each piece of data. For regulated industries requiring audit trails, this transparency matters.

Verdict: Compliance winner

Strict enterprise requirements: Cognism (ISO certs + DNC scrubbing + Article 14 notices).

Standard compliance needs: All three cover GDPR/CCPA basics with DPA available.

Audit trail transparency: FullEnrich (source-level visibility + published DPA + no database storage).

Cognism vs UpLead: Which one fits your GTM best?

Your Situation | Best Choice | Why |

|---|---|---|

SMB with <$5K budget | UpLead | $99-$199/month, no annual lock-in |

Enterprise EMEA prospecting | Cognism | 180% more UK data, Diamond Data® phones |

API-first enrichment | FullEnrich | Full API on $29/month plan |

Global prospecting | FullEnrich | 80-85% match rates across all regions |

Phone-heavy outbound | Cognism | 98% phone accuracy, 87% connect rates |

Email campaigns | UpLead | 95%+ verification + credit-back guarantee |

Low match rates currently | FullEnrich | Multi-source finds what single-source misses |

Strict GDPR requirements | Cognism | ISO certs, DNC scrubbing, Article 14 notices |

Month-to-month flexibility | UpLead or FullEnrich | Cognism requires annual contracts |

Mid-market SaaS (NA) | UpLead | Strong NA coverage, budget-friendly |

Need intent data | Cognism | Bombora-powered + sales triggers |

Agency managing clients | FullEnrich | Usage-based scales efficiently |

The uncomfortable truth about single-source data

Here's what Cognism and UpLead won't advertise:

Even 95% accuracy means 5 out of 100 prospects are unreachable. At scale, that's massive pipeline leakage.

Worse, match rates vary wildly by geography. A U.S. vendor might hit 70% in North America but 10-20% in EMEA.

The single-source problem: When their database doesn't have the contact, you've wasted the credit. Period.

No amount of verification helps if the data doesn't exist in their system.

What you get with FullEnrich

✓ 15+ providers aggregated (Apollo, Clearbit, Snov, Hunter, 11+ more)

✓ Credits only on verified matches (no waste on "not found")

✓ Triple email verification (sub-1% bounce rate)

✓ 3-12 month credit rollover (not monthly expiration)

✓ API-first on all plans ($29/month, no gate)

✓ Source-level transparency (audit trails)

✓ SOC 2 Type II certified

Try it yourself

Your current approach costs you three ways:

Credits wasted on blanks

Opportunities lost to incomplete coverage

Time managing multiple subscriptions

Waterfall enrichment solves all three.

Start with 50 free credits. No credit card required.

Cognism vs UpLead: Which is better?

If you're an enterprise team prospecting in Europe with budget above $15K and need phone-verified data, Cognism wins.

If you're SMB/mid-market needing verified emails on a budget with monthly flexibility, UpLead wins.

If you want maximum coverage across all regions without vendor lock-in, FullEnrich wins.

It all comes down to who you are and what you need.

Enterprise + EMEA + big budget? Cognism.

SMB + emails + tight budget? UpLead.

Anyone wanting max coverage at low cost? FullEnrich.

Come into each tool knowing what specific workflow you're trying to build. Without a clear use case in mind, you'll struggle to evaluate which platform actually solves your problem.

Looking beyond Cognism and UpLead? There are some Cognism alternatives or UpLead alternatives, like FullEnrich, worth exploring.

Happy prospecting!

FAQ: Cognism vs UpLead

What is the difference between UpLead and ZoomInfo?

UpLead: $99-$199/month, transparent pricing, 160M contacts, strong email verification. ZoomInfo: $15K+/year (quote-based), 320M contacts, stronger North America coverage, more features. ZoomInfo is enterprise-focused with higher cost and complexity.

Is Cognism a good company?

Cognism has clean compliance track record, ISO certifications, positive G2 reviews (4.6/5 stars). Users praise EMEA data quality and Diamond Data® phone accuracy. Main complaints: expensive, annual-only contracts, weak APAC coverage.

Does Cognism use AI?

Yes, Cognism uses AI for email validation, data verification, and its Sales Companion feature that surfaces recommended contacts and buying signals based on triggers like funding or job changes.

Other Articles

Cost Per Opportunity (CPO): A Comprehensive Guide for Businesses

Discover how Cost Per Opportunity (CPO) acts as a key performance indicator in business strategy, offering insights into marketing and sales effectiveness.

Cost Per Sale Uncovered: Efficiency, Calculation, and Optimization in Digital Advertising

Explore Cost Per Sale (CPS) in digital advertising, its calculation and optimization for efficient ad strategies and increased profitability.

Customer Segmentation: Essential Guide for Effective Business Strategies

Discover how Customer Segmentation can drive your business strategy. Learn key concepts, benefits, and practical application tips.